Why we believe the industry cycle in the Eurozone is finally turning

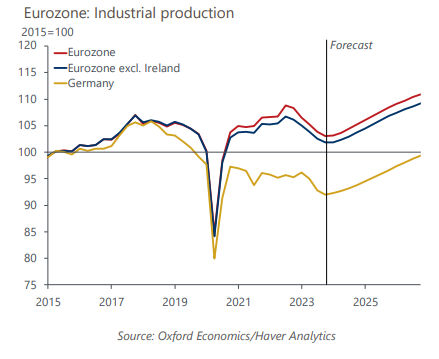

Even though incoming hard data on eurozone industry is still downbeat, leading indicators

suggest that we’re at a turning point. We expect favourable cyclical and structural tailwinds will now take over, and industry output to accelerate through this year to 2% y/y growth by Q4.

What you will learn:

- De-stocking has likely run its course. Signs of a turnaround, such as improving new orders and demand expectations, are emerging and inventories have shrunk. The turn in the inventory cycle is broad-based across all major industry groups, despite their different starting positions. We expect this to be a key, albeit temporary, driver of the cyclical upswing in industry.

- Energy-intensive industries have sunk lower than all other industrial sectors and are not yet in recovery. But the decline in wholesale energy prices and better demand prospects are important tailwinds. We expect permanent output losses due to a level shift up in energy prices, but recent favourable developments improve the prospects for limiting them.

- A key cyclical tailwind will be consumers spending their real income gains and policy easing by the ECB and other central banks. Downside risks stem from the scale and composition of the rebound in consumer demand – which surveys suggest is the key factor limiting industry output – and the timing and magnitude of monetary policy easing.

- Recent industry performance has been uneven among eurozone economies. But we expect a broad-based recovery not just across industry groups but also countries. There are risks of a structural loss of competitiveness and adverse sectoral exposures in some economies, though, which could lead to relative underperformance during the rebound with Germany most at risk.

Tags:

Related Posts

Post

Eurozone: New wage growth data suggest no need to delay rate cuts

Our sentiment data suggests that the ECB's worries about sticky inflation driven by strong wage growth are misplaced. The sentiment data-based nowcast, which allows us to track labour market developments in near-real time, suggests that pay growth continued to cool at the start of 2024 and is running below the ECB's projections.

Find Out More

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More

Post

Industry Forecast Highlights: Industry to rebuild momentum in 2024

As 2024 progresses global industrial activity should pick up and begin to rebuild some momentum. In annual terms, we expect growth of 2.7% in industry this year.

Find Out More