Why the next era of inflation may be benign globally

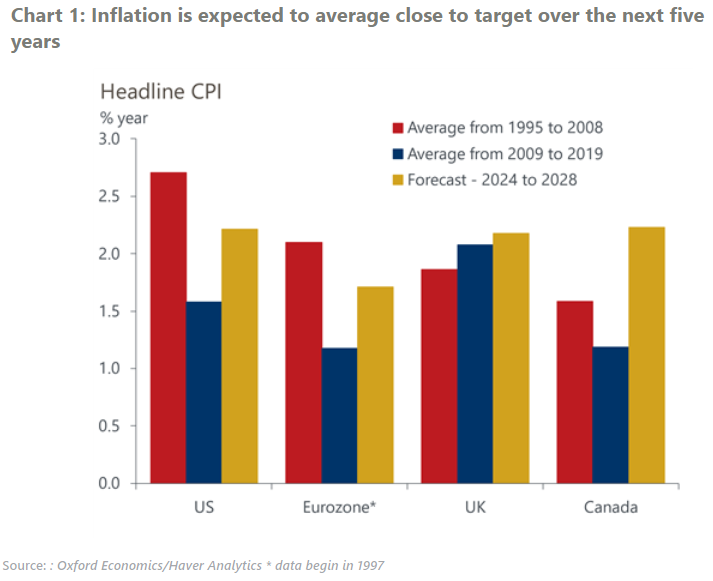

A return to the sustained ‘lowflation’ of the 2010s is unlikely, in our view. But we also doubt that the economic landscape has changed significantly enough that inflation will ‘unanchor’ from target at a higher level. Over the longer-term, we expect inflation to average around 2%, though this will include longer periods above target than was the norm post-financial crisis.

What you will learn:

- After a period of exceptionally low and stable inflation in the 2000s and 2010s, several factors –especially greater geopolitical instability and a more extreme climate – could lead to more supply shocks in the future. This increases the chances of inflation spiking up.

- Whether inflation will be generally higher or just more volatile will depend on the economic backdrop and how central banks respond. We expect higher policy rates on average, partly because domestic demand is unlikely to be as persistently weak as in the 2010s, so a repeat of the last decade’s private sector deleveraging and fiscal austerity seems unlikely.

- At the same time, the chances that strong demand will pose a risk of persistently high inflation seem overblown. More spending on defence, the greening of the economy, and aging doesn’t automatically mean bigger budget deficits. But if they do rise, then policy rates would likely be higher to offset the effect.

Tags:

Related Posts

Post

Shelter Inflation | Canada Up Close

In this month’s Canada Up Close, Cassidy Rheaume, Associate Economist, discusses why we expect lower house prices and falling mortgage rates will help slow headline CPI inflation in Canada.

Find Out More

Post

Dovish MPC signals a summer rate cut is likely

The Monetary Policy Committee voted to keep Bank Rate at 5.25% at May's meeting, but it also sent a clear message that a summer rate cut is likely. This could come as soon as June if data on pay and inflation data come in at, or below, expectations.

Find Out More

Post

Eurozone: Why food prices are a channel for more frequent supply shocks

More frequent adverse supply shocks mean eurozone inflation is likely to be more volatile and possibly higher on average in the future. Food prices are a key channel through which these global shocks will be transmitted, according to our analysis. We provide a quantitative assessment of the impact of a wide range of supply shocks on eurozone inflation.

Find Out More