Why China isn’t about to save the world economy

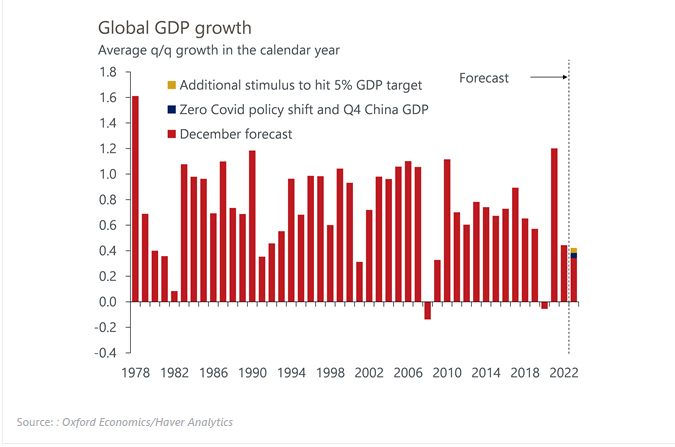

The earlier and faster than expected ending of zero–Covid restrictions in China bodes well for the global economy and adds to the recent run of positive news. But we‘re sceptical that China will save the world from recession, and we don’t think the likely increase in Chinese demand justifies recent moves in prices for metals and other commodities.

We recently revised up our GDP forecast for China due to the ending of Covid restrictions, but we estimate the boost to the world economy will be small. Simulations using our Global Economic Model suggest the level of world GDP by the end of 2023 will be just 0.15% higher.

Even this mild bump might exaggerate the positive spillovers from China to the rest of the world, given that its domestically-focused service sector will be the key beneficiary of the policy shift.

Tags:

Related Posts

Post

FOMC minutes: Policymakers flex, markets not impressed

We were a little surprised that Fed officials had not pushed back harder against market expectations for aggressive rate cuts this year, but perhaps they wanted to let the minutes from the December meeting of the Federal Open Market Committee do the work.

Find Out More

Post

A weaker dollar hinges on better global growth prospects

The dollar will continue to be supported by a high carry and the relative resilience of the US economy. Even the recent loosening of financial conditions – itself based on the pullback in yields and a more flexible Fed – have only partially dented the USD bullish trend.

Find Out More

Post

Disinflation will force ECB to cut rates earlier than expected

One of our key macro calls for 2024 is our view that eurozone inflation will be lower than what the market and what the ECB expects.

Find Out More