What’s driving the renminbi in China?

The People’s Bank of China has leaned against persistent renminbi weakness by consistently fixing the currency on the stronger side in recent months. Amid this heavy currency intervention, however, we don’t think there’s a line-in-the-sand dollar/renminbi level that the PBOC is fundamentally preoccupied with. Rather, the central bank is concerned with ensuring that depreciation expectations remain anchored.

What you will learn:

- Recent historical data suggests that domestic fundamentals are the primary drivers of renminbi movements, with external factors such as rate differentials mattering to a smaller extent.

- In the near-term, the longevity of a dollar rally, latent credit stresses within the Chinese economy, and further rate cuts likely in the pipeline will keep the renminbi hovering near historical highs going into 2024.

- Evidence about the role of geopolitical tensions in driving near-term movements in China’s currency is more ambiguous, though one caveat is that the current political backdrop is far more complicated than direct comparisons with historical escalation events would imply.

- Historically, our analysis shows that depreciation pressures are heaviest in episodes of economic and trade-related tensions, which also invites the strongest currency response from the PBOC.

Tags:

Related Posts

Post

What happens if markets lose faith in the UK government’s fiscal approach?

The Budget on November 26 will be a key test of market confidence in the UK government's fiscal approach. If the government missteps and markets take fright, we think that sterling depreciation would accompany higher gilt yields.

Find Out More

Post

The Digital Frontier—can the AI hype go on forever?

We believe that the current AI hype in financial markets will only be justified if companies can adopt AI quickly and effectively. In The Digital Frontier series, we will evaluate the state of AI and data centre investment and explore implications for different countries, cities, and sectors.

Find Out More

Post

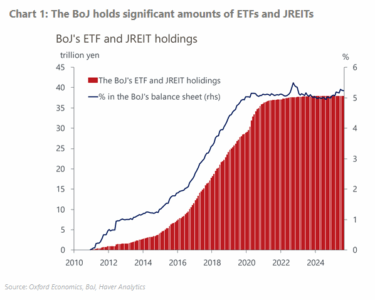

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More