Weak world trade still a drag on global growth

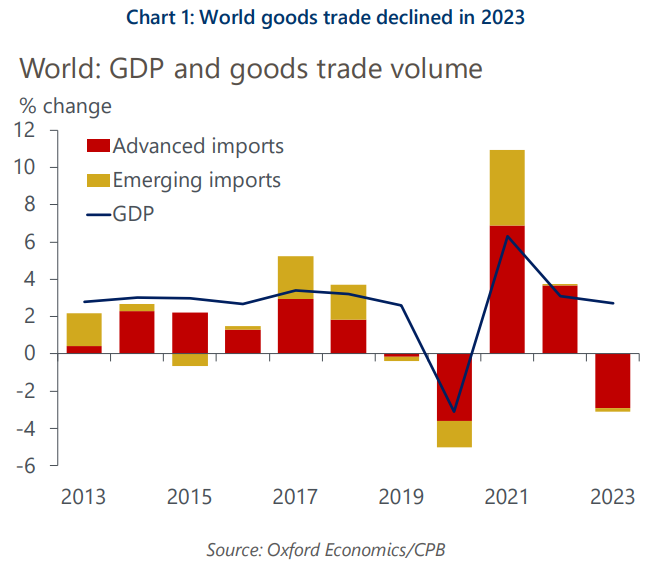

World goods trade declined in 2023, reversing the trend of 2022. This development points to the resumption of the decade-long pattern of slow global trade growth relative to GDP. Recent trade trends imply downside growth risks for 2024 and the longer-term outlook still looks to be one characterised by ‘slowbalisation’, especially with protectionism a rising issue.

What you will learn:

- Weakness in goods trade in 2023 was centred in advanced economies, especially Europe and Japan. Our survey-based indicator suggests global goods trade growth will remain stagnant into mid-2024, presenting a downside risk to our baseline trade forecasts.

- Muted external demand growth is one of the factors behind China once again starting to export disinflation to the world via lower export prices. The impact is not yet very large, but it could fuel protectionist pressures.

- Trade restrictions, in part linked to geopolitics, are a growing risk to long-term trade growth. The stock of restrictions has risen notably since 2016-2017 and there is a major new issue in the shape of distortionary industrial policies.

- The main area of fragmentation in the world trade system remains the US-China trade relationship. There are some signs this is spreading, however, such as the striking collapse of FDI into China in 2023, which implies lower trade in the future.

Tags:

Related Posts

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More

Post

China decoupling – how far, how fast?

Economic decoupling from China is ongoing, but the latest evidence suggests that, especially outside the US, the process is gradual and piecemeal. Trade decoupling may be slowly spreading from the US to other advanced economies, however surveys suggest foreign investors' attitudes to China improved slightly in 2023, though they are still more negative than a few years ago.

Find Out More

Post

Trumponomics: The economics of a second Trump presidency

We modeled two scenarios in which former President Donald Trump returns to the White House and Republicans gain full control of Congress after the 2024 election.

Find Out More