Wage rises in 2024 look set to be as high as this year in Japan

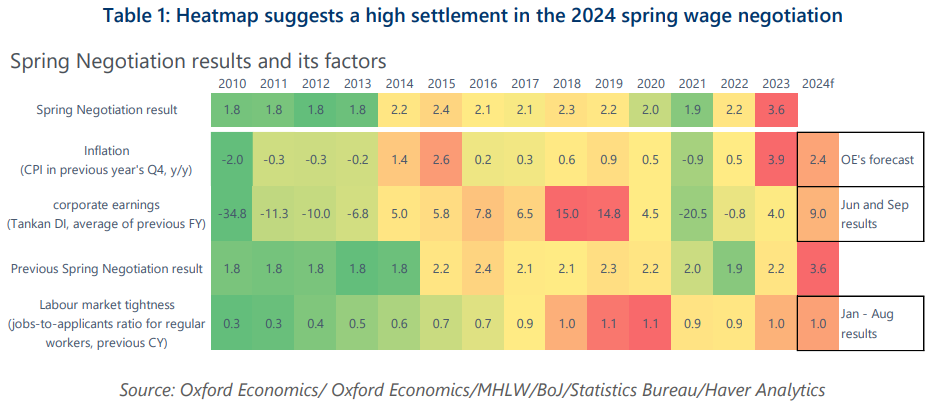

More market participants appear to have become confident that the wage-driven inflation is real, which will encourage the Bank of Japan to start normalizing its super-accommodative monetary policy in 2024. We revised up our projection for the spring wage settlement in 2024 to match the strength of the settlement in 2023. We believe that wage increase will continue after 2025, but achieving wage-led 2% inflation is still a long way off.

What you will learn:

- In addition to the need to compensate for higher-than-projected inflation in 2023, a severe labour shortage has pushed some firms with high profitability to raise wages more aggressively. Less profitable firms have no choice but to follow, spending their retained cash.

- Despite robust wage growth, we project that inflation will trend down throughout 2024 to a low 1.4% y/y in Q4 2024, from 3% in September 2023, as the pass-through of past import inflation wanes.

- We estimate growth in household income and consumption will not be robust enough to bring inflation back to 2%, although this is subject to high uncertainty. The magnitude and scope of wage increases will be constrained by Japan’s demographics and stagnant productivity growth.

- Based on the inflation outlook, we expect the BoJ to eliminate the negative interest rate in April 2024 after confirming the robust wage settlement, arguing that the economy is on track to achieve the 2% target in the coming years. Despite speculation about further rate hikes, however, we think the BoJ will maintain the short-term rate at an effective zero level thereafter.

Tags:

Related posts

Post

Surprisingly strong wage data ends NIRP and YCC in Japan

The Bank of Japan (BoJ) decided to end its negative interest rates policy and set the target band for the overnight market rate at 0%-0.1% at Tuesday's meeting, earlier than our call for April.

Find Out More

Post

Will Japan policy adjustments accompany the end of NIRP?

Markets appear to be increasingly converging with our forecast that the Bank of Japan will abolish its negative interest rate policy at the April meeting, but views diverge on whether any other policy adjustments will accompany the end of NIRP.

Find Out More

Post

No change in policy as BoJ waits for wage data

The Bank of Japan left both short-term and long-term policy rates unchanged at Tuesday's meeting. Amid a decline in global yields, pressures on the Yield Curve Control (YCC) policy framework from bond and foreign exchange rate markets have eased.

Find Out More