Research Briefing

| Feb 10, 2023

US supply chain stresses fade as recession nears

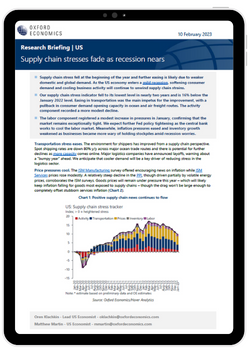

Supply chain stress fell at the beginning of the year and further easing is likely due to weaker domestic and global demand. As the US economy enters a mild recession, softening consumer demand and cooling business activity will continue to unwind supply chain strains.

What you will learn:

- Our supply chain stress indicator fell to its lowest level in nearly two years and is 16% below the January 2022 level. Easing in transportation was the main impetus for the improvement, with a pullback in consumer demand opening capacity in ocean and air freight routes. The activity component recorded a more modest decline.

- The labor component registered a modest increase in pressures in January, confirming that the market remains exceptionally tight. We expect further Fed policy tightening as the central bank works to cool the labor market. Meanwhile, inflation pressures eased and inventory growth weakened as businesses became more wary of holding stockpiles amid recession worries.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More