US Recession Monitor – No glaring fissures

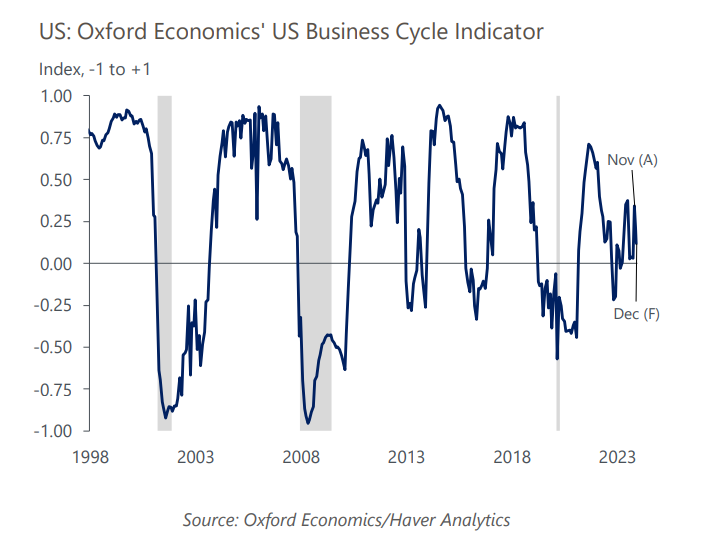

The odds of a recession have declined over the past several months because of a strong labor market, a deceleration in inflation, and looser financial conditions on the back of the impending Fed pivot to rate cuts. The January baseline forecast included an upward revision to GDP growth this year, a lower peak in the unemployment rate, and stronger consumer spending. Our subjective odds of a recession this year are now less than 50%.

What you will learn:

- While we expect the pace of spending to slow in 2024, there are reasons to believe consumers will keep their wallets open. Strong wage gains alongside falling inflation means real wage gains will remain a support to consumption.

- There are few signs of widespread layoffs. The Fed still needs to thread the needle and ensure monetary policy does not become too restrictive, but we believe the rebalancing of the labor market is needed for the Fed to engineer a soft landing.

- Temporary help services, a potential warning sign for the broader labor market, trended lower in recent months, but vacancies rather than employment continue to bear the burden of softening labor demand.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More