Research Briefing

| Dec 19, 2023

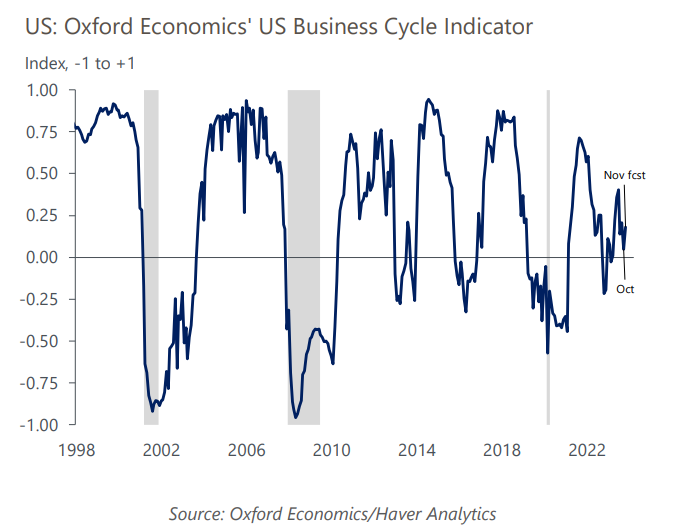

US Recession Monitor – A soft landing is moving into sight

The economy is weakening, but the incoming data are consistent with a slowdown rather than a technical recession. Growing expectations of rapid rate cuts next year, to which the Fed had little pushback, have loosened financial conditions, which, if sustained, reduces the downside risks to the economy in the first half of the year. The peak drag from past tightening in credit conditions is in the rear-view mirror.

What you will learn:

- Job growth has softened, but there are few signs that it will trigger a significant increase in unemployment. Jobless claims remain low and the unemployment rate ticked lower in November. It is not our base case, but the bigger risk still appears to be that labor market conditions remain too tight, pushing nominal wage growth up again. With wage growth already strong, the risk is that the Fed keeps interest rates higher for longer than markets anticipate.

- Despite the 20% fall in oil prices since mid-October amid stronger US oil production, inflation remains above the Fed’s target. In a plausible worst-case scenario where the Israel-Hamas war broadens into a much broader regional conflict, the disruption could push oil prices as high as $150 per barrel. We modeled such a scenario, with a sharp rise in oil prices, shocks to business and consumer confidence, and financial market weakness culminating in a drag on US GDP large enough to push the economy into a mild recession.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More