Research Briefing

| Feb 8, 2024

US e-commerce spending points to industrial outperformance

Our expectation for the US industrial sector to outperform other major commercial real estate sectors is predicated on the persistence of e-commerce sales growth supporting US warehouse demand. Over the next five years, we predict industrial total returns will average 6.9% per year, compared to all-property returns of 6.4%.

What you will learn:

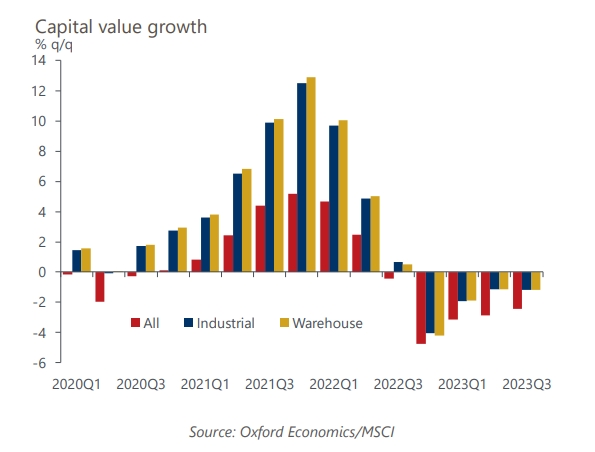

- Industrial capital value growth has surpassed the all-property index consistently since Q1 2020. At its highest, q/q industrial capital value growth was 12.5%, more than double the all-property growth of 5.2%. Our expectation for consumer spending to grow in the near term should propel industrial assets to lead commercial real estate once the recovery begins in 2025.

- With the onset of the pandemic, e-commerce sales consistently recorded y/y growth of around 50% each quarter between Q2 2020 and Q1 2021, but e-commerce growth moderated in 2022 and 2023 as shoppers returned to stores and shifted more of their spending toward services. We assume e-commerce sales growth will continue in 2024, albeit possibly below what was recorded in 2023.

- In our assessment of the impact from the increased conflict in the Red Sea, there is upside risk to inflation in 2024. This would likely weaken goods consumption and potentially force e-commerce sales lower in the near term, which could cause a disruption in industrial demand. However, the timing of the industrial pricing recovery probably would not be delayed.

Tags:

Related Services

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More