US consumer spending depends on continued savings drawdown

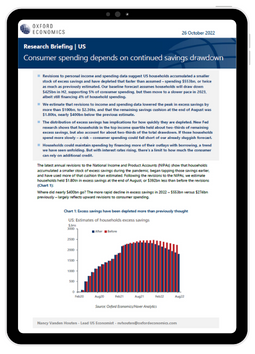

Revisions to personal income and spending data suggest US households accumulated a smaller stock of excess savings and have depleted that faster than assumed – spending $553bn, or twice as much as previously estimated. Our baseline forecast assumes households will draw down $425bn in H2, supporting 5% of consumer spending, but then move to a slower pace in 2023, albeit still financing 4% of household spending.

What you will learn:

- We estimate that revisions to income and spending data lowered the peak in excess savings by more than $100bn, to $2.36tn, and that the remaining savings cushion at the end of August was $1.80tn, nearly $400bn below the previous estimate.

- The distribution of excess savings has implications for how quickly they are depleted. New Fed research shows that households in the top income quartile held about two-thirds of remaining excess savings, but also account for about two-thirds of the total drawdown. If those households spend more slowly – a risk – consumer spending could fall short of our already sluggish forecast.

- Households could maintain spending by financing more of their outlays with borrowing, a trend we have seen unfolding. But with interest rates rising, there’s a limit to how much the consumer can rely on additional credit.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US Industry Service

Outlook for 261 detailed sectors in the NAICS classification.

Find Out More