United States: Student loan payments are less concerning going forward

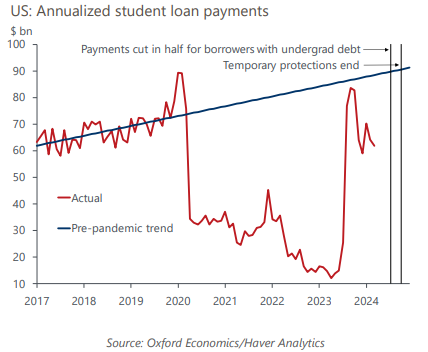

Despite last summer’s US Supreme Court decision, the Biden administration has forgiven $153bn in student loan debt through piecemeal actions. This, combined with a new, more generous income-driven repayment plan and a yearlong grace period following the end of the pandemic-era pause on student loan payments, has reduced the amounts borrowers in the aggregate are paying back to the Department of Education.

What you will learn:

- These recent student loan actions benefit consumer spending through two channels: household net worth and cash flow. The cash-flow effect is dominant over the wealth effect, but the two combined may boost the level of real personal consumption by 0.1% or more, based on simulations of the Oxford Economics’ Global Economic Model.

- Monthly student loan payments are tracking $23bn lower than their pre-pandemic trend on an annualized basis. How much this gap will widen or narrow in the coming months remains to be seen, but the biggest wild card for the path of student loan payments – and the federal deficit – is the administration’s latest plan to forgive student loan debt.

Tags:

Related Posts

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

The economic costs of the Key Bridge collapse

The collapse of the Francis Scott Key Bridge in Maryland is another reminder of the US vulnerability to supply-chain shocks.

Find Out More

Post

SEC climate disclosure rules will help investors understand their climate risks

SEC climate disclosure rules require firms to disclose scope 1 and 2 emissions. How will these new SEC climate rules help investors make decisions?

Find Out More