Too soon to call an end to the house price correction

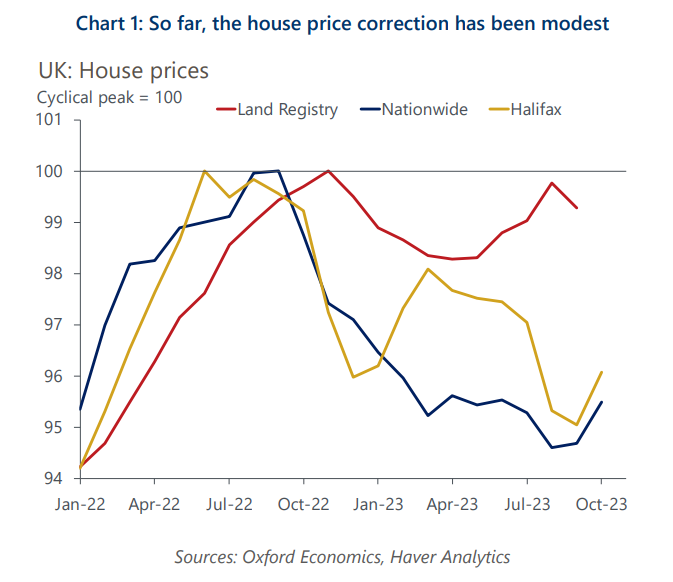

The UK’s house price correction has been mild so far and recent data has indicated the market may be more resilient than we had thought. But we still think the downturn has some way to run.

What you will learn:

- Though mortgage rates have dropped back in recent months and wage growth has been very strong, we estimate that house prices are still more than 20% overvalued based on the affordability of mortgage payments. This is likely to mean that transactions remain very low.

- Meanwhile, the consequences of tighter monetary policy continue to emerge. Mortgage arrears have reached a seven-year high. A further 1.5mn mortgagors are due to refinance at much higher rates before the end of 2024, so the number of borrowers experiencing financial stress is likely to rise. The average mortgage has increased sharply relative to incomes, which could exacerbate the problem.

- We expect house prices to fall by just under 9% from peak-to-trough, which would be just over half the drop seen in the global financial crisis. Our less downbeat view of this cycle is due to the much lower unemployment rate and slow rise in average mortgage rates.

Tags:

Related Posts

Post

Booms, busts and bulk water – a familiar infrastructure challenge is unfolding now

Australia last experienced a boom in water-related infrastructure construction in the 2000s and early 2010s, following two decades of underinvestment in the 1980s and 1990s.

Find Out More

Post

Construction across sectors hitting record highs now and by decade’s end as economy slowly gains momentum

Australia’s construction sector is entering a defining decade. At the Australian Construction Outlook Conference 2025, Oxford Economics Australia explored the transformative trends shaping growth to 2030 - from AI-driven data centers and electrification projects to government-funded infrastructure and rising demand for social and retirement living.

Find Out More

Post

Australian office vacancy rates remain elevated in Australia

The latest Property Council data confirms all the major office markets remain oversupplied, with the suburban markets generally in a worse position than the CBDs.

Find Out More