Tight labour market and firm pay growth will worry the MPC

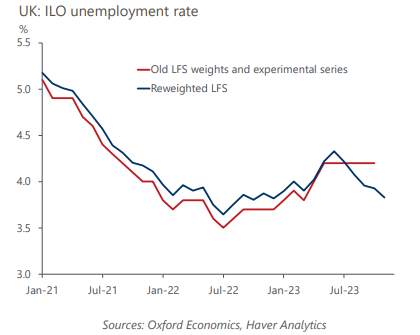

Contentious new Labour Force Survey data implies the UK jobs market was much tighter in H2 2023 than we previously thought, while our own sentiment data developed with Penta suggests conditions are little changed in early-2024.

What you will learn:

- Our nowcast also suggests that the slowdown in wage growth has faded. We think this combination of a tight labour market and solid wage growth is likely to lead the Monetary Policy Committee to take a cautious approach to the timing and pace of rate cuts.

- Though the LFS has been reintroduced, the new estimates don’t tackle the key problem of small samples. This issue should be addressed when a transformed LFS is belatedly introduced in September, but could also mean there are further revisions to the recent data.

- Concerns over the reliability of official data show the importance of monitoring alternative data sources. Our sentiment indicators offer a consistent overview of labour market developments, as well as providing a timelier snapshot of conditions.

Tags:

Related Posts

Post

Three reasons why UK inflation will swiftly return to target

The UK inflation outlook has been transformed by steep falls in oil and gas prices and the recent softening in core price pressures. We now expect CPI inflation to average 2.1% in 2024, down from our November forecast of 3.1%. Inflation is on track to return to the 2% target in April.

Find Out More

Post

UK: Housing market on course for a soft landing

The recent sharp fall in mortgage rates and continued strong growth in wages has significantly reduced the scale of the UK's housing affordability problem. Consequently, the risk of a steep correction in house prices is much lower than it appeared a few months ago. We also expect the recent steady pickup in housing market activity to continue.

Find Out More

Post

Exploring the implications of higher pension contributions in the UK

Oxford Economics have collaborated with and Royal London to explore the implications of increasing mandated minimum pension contributions in the UK.

Find Out More