The unprecedented price passthrough is unsustainable in Japan

We project Japan’s CPI inflation will slow in H2 as import costs trend downward. The current record price passthrough is unsustainable given sluggish demand and firms’ weak pricing power.

What you will learn:

- After decades of cost-cutting, firms no longer have the capacity to absorb a jump in imported inflation. With demand resilient in the aftermath of the pandemic shock, firms now see less risk of losing market share in raising prices, given that their competitors are doing the same.

- That said, the great price passthrough does not mean Japanese firms have gained an upper hand and can keep on raising prices. The gap between output price DI and input price DI indicates that firms have compressed margins by passing on rising costs to prices only partially and gradually.

- Output price DI for manufacturers, especially those in basic materials industries, has shown signs of peaking. For now, non-manufacturing firms are continuing to pass on input costs, taking advantage of pent-up demand for services. But stagnant growth in household income will not allow firms to keep raising prices much longer.

Tags:

Related posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

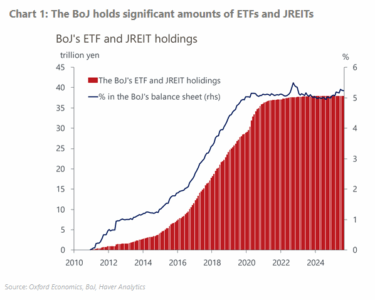

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More