The terminal policy rate is in sight for India

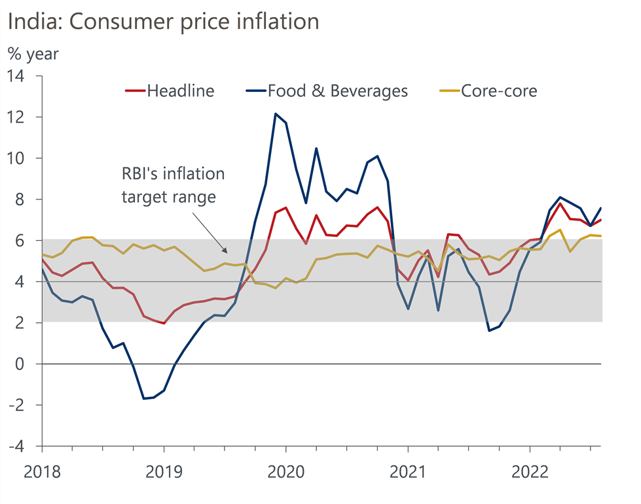

Recent developments strengthen our view that India’s inflation has passed its peak. The steep rise in headline CPI that began in late 2021 was largely driven by imported inflation due to supply chain issues and sky rocketing commodity prices following Russia’s invasion of Ukraine. These pressures are now retreating.

What you will learn:

- We expect the Reserve Bank of India (RBI) will hike another 35bps-50bps at its meeting this month. We think the bounce back in India’s CPI to 7% in August and a hawkish US Federal Reserve justify the move.

- However, beyond that, easing supply bottlenecks and a much weaker growth outlook have diluted the case for further aggressive tightening. We expect the RBI to deliver a final 25bps hike in Q4 and then pause for most of 2023.

- We expect CPI inflation to gap lower from Q2-2023 after having hovered around 7% for a short period. This reflects our view of quicker easing of supply constraints and external price pressures next year, facilitated by weakening demand.

Tags:

Related posts

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Singapore Business Awards 2024

We're delighted that Oxford Economics has been announced as the Most Innovative Global Economic Forecasting Specialists 2022.

Find Out More

Post

The long-term trends shaping global city consumer markets

Our long-term income and consumer spending forecasts reveal the high-potential urban consumer markets of the future. We identify four key trends underpinning shifts across global urban consumer markets over the coming decades.

Find Out More