The long-term outlook for Middle Eastern cities

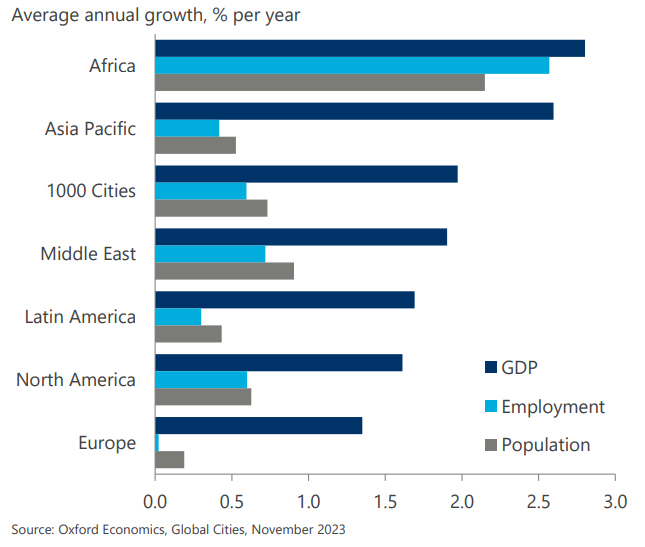

Middle Eastern cities are forecast to experience some of the fastest rates of employment and population growth over the long term. However, GDP growth is forecast to be middle of the global pack.

What you will learn:

- We expect GDP growth to average 1.9% per year between 2024 and 2050 in Middle Eastern cities, which will trail African and Asia Pacific cities, but still outperform those in the Americas and Europe.

- Whilst GDP growth will be marginally weaker than the global city average, favourable demographics will contribute to strong population and employment growth. Population in the region’s major cities is expected to grow at 0.9% per year, while employment will grow at just over 0.7% per year—faster rates than anywhere else in the world, except in African cities.

- Whilst the rate of migration to Middle Eastern cities is expected to slow, the resident population remains very young and generally under-utilised in the labour market. With healthy rates of natural change and increasing participation in the labour market, the primary driver of strong population and employment growth will come from the local-born population of Middle Eastern cities.

Tags:

Related Posts

Post

Economy Middle East: Navigating the GCC economic landscape amid challenging changes

Scott Livermore, Chief Economist and Managing Director at Oxford Economics, delves into the repercussions of oil cuts in the region and what can be done to mitigate them.

Find Out More

Post

New cruise deployment trends emerging one month into the Middle East conflict

One month into the Israeli-Palestinian conflict, cruise operators have responded swiftly to geopolitical disturbances in the Middle East by modifying or cancelling itineraries.

Find Out More

Post

Global Scenarios Service: Middle East Escalation

Global growth prospects for the year ahead remain weak. We continue to see a prolonged period of steady and unspectacular growth over the coming quarters, despite a slight upward revision to our baseline forecast in the period since our previous Global Scenarios Service report.

Find Out More