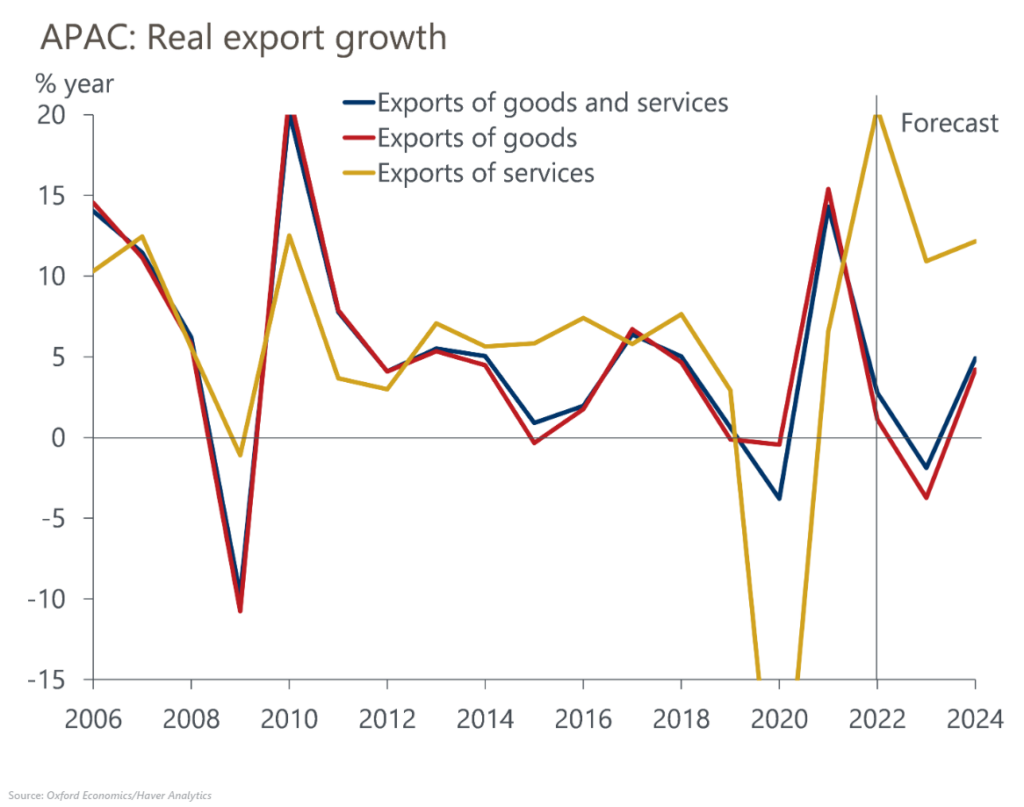

The export slump isn’t over yet in APAC

Export volumes of Asian goods are tumbling at a pace not seen since the onset of the pandemic in 2020. The pandemic slump proved short-lived, but we think the current plunge in exports has further to run, with sequential declines likely this quarter and next.

We expected Asia’s export outperformance to end abruptly, but the steepness of the plunge has exceeded even our downbeat expectations. Last October, we highlighted three drivers of the export slowdown:

- a post-pandemic shift in global consumption back to services

- a turn in the global semiconductor cycle

- an easing of demand due to weak growth in key export partners

What you will learn:

- Close analysis of the data suggests more influence so far from the consumption shift and semiconductor trade. The big question now is whether weak growth will come more into play.

- Downside risks around export-partner growth have moderated recently. Still, a global recession in H1 remains our baseline view, which would weigh further on Asian exports.

- We also doubt the reopening boost from China will be enough to offset that, as its recovery is likely to quickly run into structural headwinds.

- Overall, we expect continued contraction. Albeit with the fall in exports having been more front-loaded than we had expected, we now anticipate more moderate declines over H1 2023.

Tags:

Related Resouces

Post

Indian and Australian cities to outpace rivals over 2024-28

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

Find Out More

Post

Infographic: key themes driving location decisioning in 2024

In this infographic, we present the themes that are crucial to location decisioning in 2024 and pinpoint potential bright spots.

Find Out More

Post

Asian powerhouses continue to climb the global rankings

Cities dominate the global economy. Today, 19 cities have achieved urban economic powerhouse status, with annual GDP greater than $500 billion. These are predominantly in the US, but over the coming decades, the urban landscape will shift as large and fast-growing cities across Asia emerge to challenge the current hierarchy.

Find Out More