The costs and eventual benefits of smooth decarbonisation in ASEAN

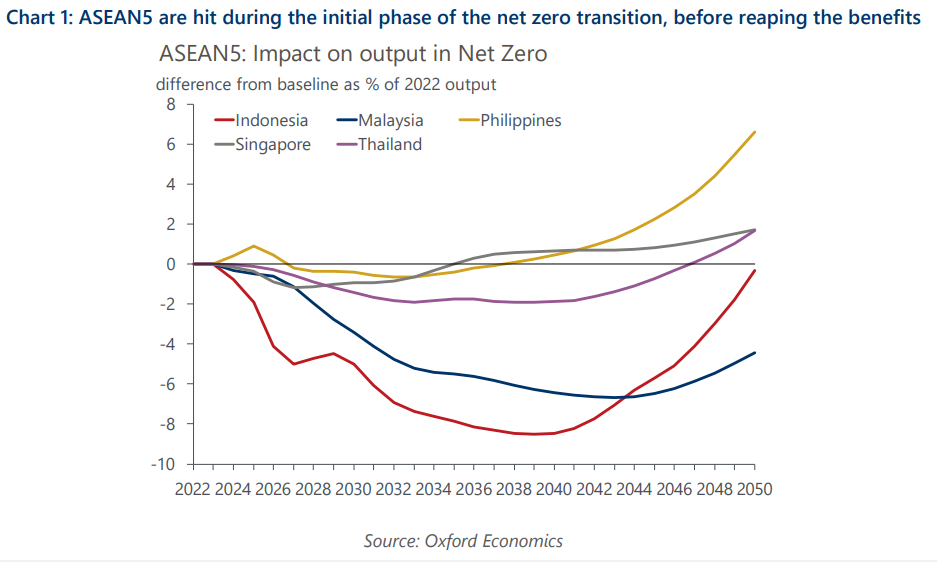

Reaching net zero carbon emissions by 2050 would likely have a larger impact on economic activity initially in ASEAN5 countries than more gradual decarbonisation. But our modelling suggests the gap would narrow in later years and turn positive in most places approaching 2050.

What you will learn:

- The initial costs of decarbonisation largely stem from higher energy costs as carbon taxes are levied, which businesses will have to bear as the switch to renewables takes time. Offsetting benefits are likely to accrue in later time periods from the avoided impacts of climate change, declining energy prices, and higher green investment.

- Net energy exporters – Malaysia and Indonesia – are likely to face the biggest upfront costs. Indonesia looks set to have a particularly tough time at the start given its high reliance on coal in the energy mix. But over the longer term, it should eventually see a larger benefit than Malaysia due to higher growth in public services and declining energy costs.

- Thailand is in the middle of the pack. It has a high energy intensity, though the impact is likely to be offset by lower reliance on coal.

- Initial costs are more limited in Singapore and the Philippines due to low energy intensity – both will see economic benefits from the transition during the 2030s. The Philippines stands out with the highest output above our baseline in the long term due to its high potential in electric power generation and distribution.

Tags:

Related Posts

Post

Monetary policy in ASEAN shifts focus

With the US Fed expected to remain on hold for a prolonged period, rate decisions in Asia are likely to become more idiosyncratic. We discuss the actions of three central banks, namely Bank Indonesia (BI), Bank Negara Malaysia (BNM), and the Bank of Thailand (BOT).

Find Out More

Post

The miracle growth story of Vietnam has further to unfold

Vietnam's GDP grew by an average rate of 7% annually in the past three decades, surpassing all its ASEAN regional peers. Although 2023 and 2024 are set to see Vietnam's weakest growth outside of Covid years, we think the pain is short-term.

Find Out More

Post

Three key idiosyncrasies in Asian trade and why they matter

Idiosyncrasies in recent Asian trade data suggest that country-specific factors are becoming more influential and causing some countries' exports to buck cyclical trends. If that continues, the fortunes of regional exporters will diverge further in 2024, though we still think the overall export trend will be subdued.

Find Out More