The big questions for China macro policy this year

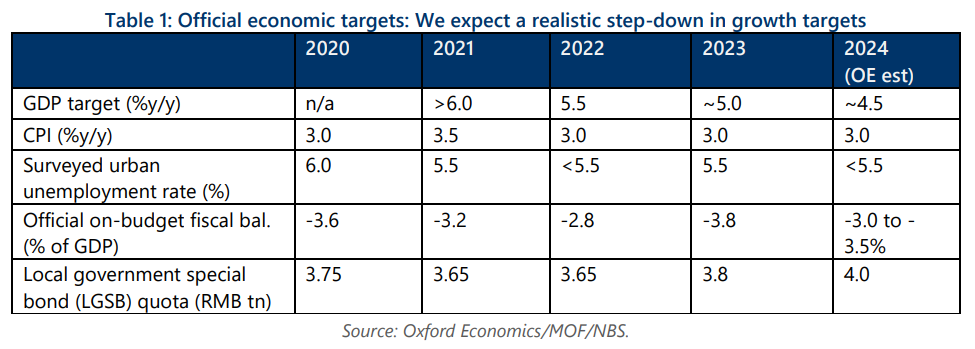

Ahead of this spring’s Two Sessions, we expect officials to realistically stake their growth target at around 4.5% in 2024 – a more sustainable, though likely still above-potential, pace than in 2023. Risks to our baseline forecast are titled to the upside, as fiscal easing could prove more forthcoming, and the poor performance of exports could improve. This report analyses some of the key questions regarding China macro policies in 2024.

What you will learn:

- Fiscal stimulus in 2024 will include greater support for policy banks, tax waivers, and other cost-offsets for businesses, plus spending on both old and new infrastructure. Quasi-fiscal tools, such as the pledged supplementary lending (PSL) facility, will also play a bigger role.

- Broad-based, direct support for household consumption still seems unlikely, even as China grapples with a confidence crisis. We expect private consumption to slow to a respectable 5.2% in 2024, from an estimated 8.7% in 2023.

- Property easing will likely continue in the form of further liquidity injections into policy banks for housing projects, more direct subsidies to improve housing affordability and induce consumers to purchase homes, and a restructuring of property developer balance sheets to liquidate high inventory and bad loans with the assistance of state banks.

- Although accommodative monetary policies are necessary, the room for a further meaningful decline in rates is limited.

- We expect a mild appreciation of the renminbi deeper into H2, ending 2024 at 7.0 to the dollar on narrowing US-China rate differentials, stabilizing domestic fundamentals, a smaller current account surplus, and continued spot intervention from the PBOC to stem depreciation pressures.

Tags:

Related Posts

Post

The latest export from China is … deflation

We expect Chinese export price deflation to provide a helpful tailwind in the struggle to bring EM inflation back to target.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More