Taiwan earthquake hit local chip production, but only temporarily

Taiwan was hit by the 7.2 magnitude earthquake on 3 April, the strongest in 25 years. However, the economic impact seems to be manageable so far, thanks to sparse population close to the epicentre, improving building codes and stronger disaster management and awareness in the past two decades.

What you will learn:

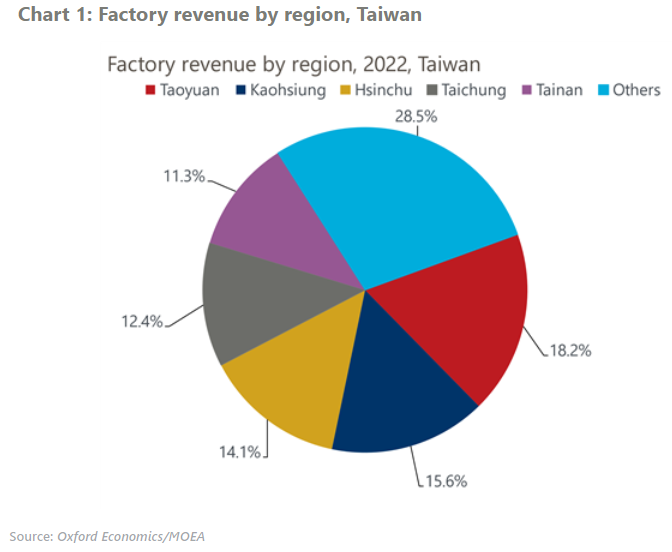

- Being the global chip fabrication hub, Taiwan’s chip production was once interrupted after the earthquake but reported no material damage to main production lines. Local chip makers have responded quickly and resumed most of the production lines since the earthquake.

- The four-days’ Qingming holiday right after the earthquake shows domestic consumption remained resilient. Agricultural prices may go up in the month because of traffic disruptions after the earthquake, adding further pressure to domestic prices following the scheduled electricity price hike in April.

- We maintain our 2024 growth forecast of 2.8% for Taiwan and continue to expect the central bank to hike rate by 12.5bps in Q2.

Tags:

Related Posts

Post

The macro impact of the AI boom in Taiwan and South Korea

The launch of ChatGPT in November 2022 made 2023 a leap forward for artificial intelligence (AI). The big battle for the future AI winners heated up and many tech companies revealed their future investment plans during the latest earnings season. A global race to build the most powerful AI chips has begun, which will potentially revolutionise the global tech sector.

Find Out More

Post

Global Scenarios Service: Middle East Escalation

Global growth prospects for the year ahead remain weak. We continue to see a prolonged period of steady and unspectacular growth over the coming quarters, despite a slight upward revision to our baseline forecast in the period since our previous Global Scenarios Service report.

Find Out More

Post

Top themes for the Chinese economy in H2

We recently received many questions on China's growth trajectory given the recent twists and turns in onshore activity and policy signals.

Find Out More