Research Briefing

| Oct 5, 2022

Surging rates push some housing markets to the brink

The ongoing surge in mortgage rates in advanced economies threatens to push some housing markets into steep downturns. Housing prices are already flat or falling in many economies, including the US, and downward pressures are set to intensify as bank credit standards tighten and recessions start to bite.

What you will learn:

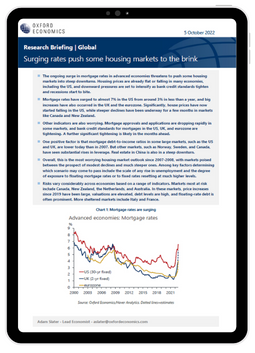

- Mortgage rates have surged to almost 7% in the US from around 3% in less than a year, and big increases have also occurred in the UK and the eurozone. Significantly, house prices have now started falling in the US, while steeper declines have been underway for a few months in markets like Canada and New Zealand.

- Other indicators are also worrying. Mortgage approvals and applications are dropping rapidly in some markets, and bank credit standards for mortgages in the US, UK, and eurozone are tightening. A further significant tightening is likely in the months ahead.

- One positive factor is that mortgage debt-to-income ratios in some large markets, such as the US and UK, are lower today than in 2007. But other markets, such as Norway, Sweden, and Canada, have seen substantial rises in leverage. Real estate in China is also in a steep downturn.

Tags:

Related Services

Service

Real Estate Forecasts and Scenarios

Understand the prospects and risks to your real estate investments by location and property type.

Find Out More

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More