Shifting Asian supply chains amid ongoing US-China frictions

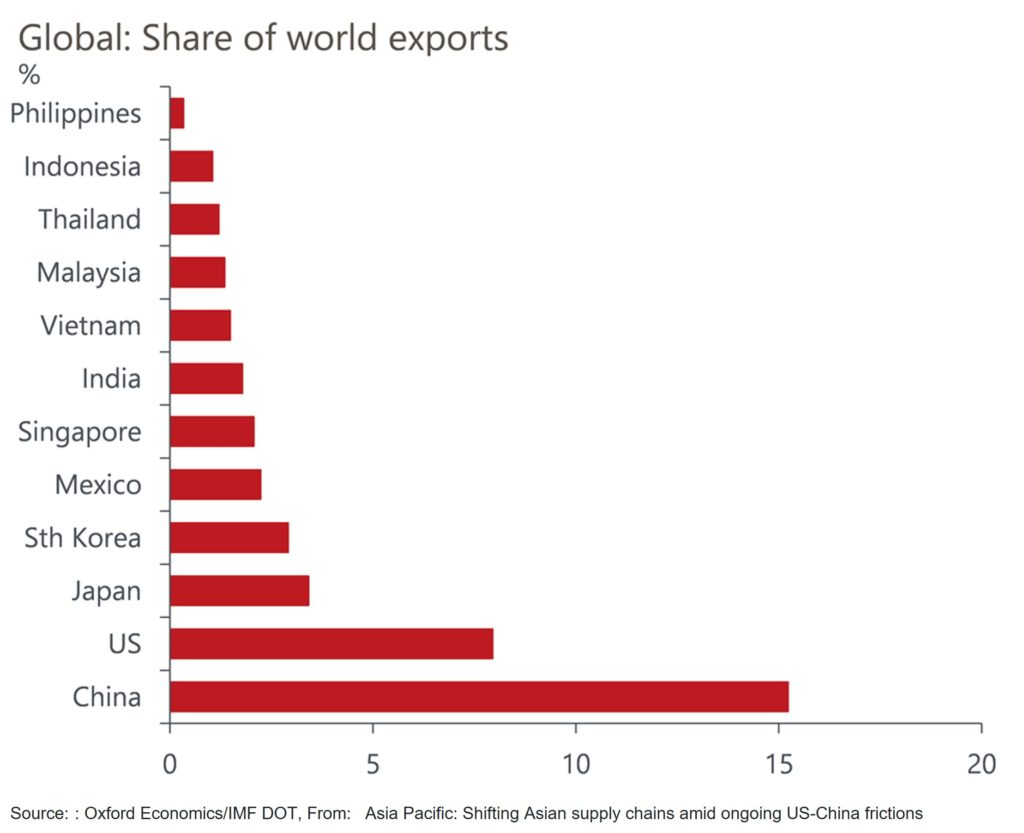

Manufacturing hubs in South East Asia are set to benefit from firms hedging against ongoing US-China frictions, in our view, and ASEAN countries will continue to be attractive destinations for investment.

What you will learn:

- We expect Vietnam in particular to be a big beneficiary given its proximity to China, participation in free trade agreements, and low-cost advantage.

- Although we expect ASEAN to become an increasing source of global manufacturing and goods exports, breaking the global and regional dependency on China would require a significant drop in the reliance on backward integration with Chinese industry. There is little evidence of this yet.

- We think it’s more likely that firms will opt for a ‘China plus-one’ strategy, reducing their dependency on China only marginally. We expect this strategy, along with growing domestic markets in ASEAN and China, will strengthen intra-regional economic linkages.

Tags:

Related Resouces

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Singapore Business Awards 2024

We're delighted that Oxford Economics has been announced as the Most Innovative Global Economic Forecasting Specialists 2022.

Find Out More

Post

The long-term trends shaping global city consumer markets

Our long-term income and consumer spending forecasts reveal the high-potential urban consumer markets of the future. We identify four key trends underpinning shifts across global urban consumer markets over the coming decades.

Find Out More