Riksbank first does not mean Riksbank alone

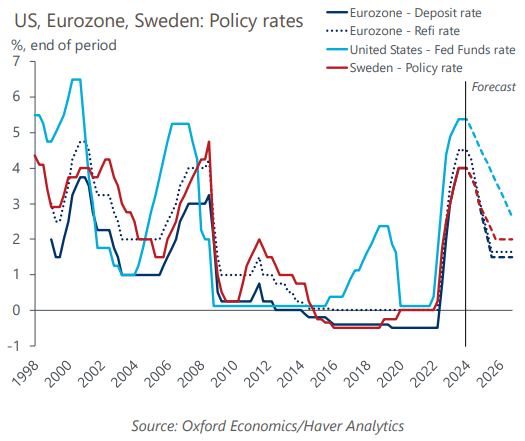

We think the Riksbank will cut rates in May, before the Federal Reserve and the European Central Bank do so. The Riksbank’s monetary policy tightening has had a large impact on the interest rate sensitive Swedish economy, while recent inflation outcomes have undershot Riksbank’s forecasts and converged to the target. The effect of an earlier rate cut on the krona is a key risk.

What you will learn:

- We believe the Swedish economy is ready for the start of the monetary easing cycle as activity is significantly below the pre-pandemic trend, headline inflation rate is close to the Riksbank’s target and core inflation has fallen precipitously since the start of this year. The two-year wage agreement from last year has kept wage growth and domestic inflationary pressures in check.

- All five members of the Riksbank’s Executive Board mentioned a rate cut in May or June at the last meeting. A rate cut in early May relies on the Fed and the ECB beginning their easing cycles soon after. A situation in which the Riksbank cuts but the Fed and ECB stay on hold for longer would weigh on the already weak krona and thus fuel imported inflation.

- We expect the ECB will start cutting rates in June and proceed at a faster pace than the Riksbank (with 100bps of cumulative rate cuts by year-end for both), which is also reflected in market pricing. This is consistent with a faster passthrough of policy changes in Sweden and the Riksbank’s cautious reaction function, as it wants to prevent stoking demand-led inflation.

- If the Riksbank waits until late June to cut, then we would marginally lower our growth and inflation forecasts for this year. But we don’t expect it to affect the pace of easing, and would still project a total of 100bps of cuts this year and a 2% terminal rate by end-2025.

Tags:

Related Posts

Post

Europe: City employment growth eases, but office sectors still lead

Labour markets in European cities have shown remarkable resilience over the last few years, and employment in office-based sectors especially so. But from this year onwards, we expect the pace of office employment growth to slow.

Find Out More

Post

Europe: Accounting for climate transition risk in CRE required returns

We are adding a depreciation risk premium that incorporates climate transition risk to our required returns framework.

Find Out More

Post

Europe: Residential opportunities have a northern bias

The outlook for European residential real estate is improving. The prospect of lower interest rates means house price corrections are probably coming to an end, while still-stretched affordability will support rental demand.

Find Out More