Red Sea shipping attacks add to inflation risks

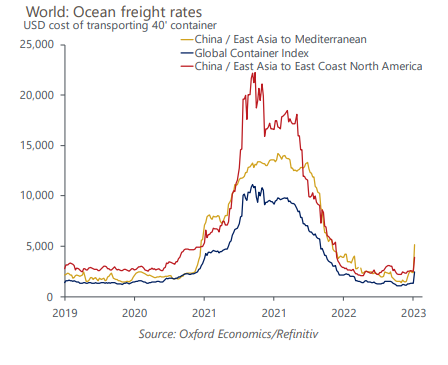

We assume the disruption to shipping caused by maritime attacks on commercial vessels in the Red Sea will be relatively short-lived and the recent spike in sea freight prices will reverse. While there will be near-term impacts for some firms and sectors, these won’t be enough to shift our baseline economic or inflation forecasts to any meaningful extent.

What you will learn:

- If the Red Sea were to remain closed to shipping for several months, however, and shipping freight costs stayed around twice the level of mid-December, this could add 0.7ppts to annual CPI inflation rates by the end of 2024.

- Still, the inflation push from this scenario wouldn’t be enough to stop world inflation from slowing over the course of this year and we doubt it would prevent the Fed and other major central banks from pivoting to rate cuts by around mid-2024. It would, however, be another reason to believe that the rate cuts priced in by markets have gone too far.

Tags:

Related Posts

Post

US supply chain stress fell at the start of peak shipping season

Supply chain strains eased in September after increasing slightly in August. Transportation pressures subsided the most of all our tracker's components, price pressures recorded a third straight monthly decline, and inventories improved.

Find Out More

Post

Global logistics challenges more than just port bottlenecks

The pandemic has tested the adaptability and resilience of transport and logistics companies. With consumers focusing their spending on goods rather than on services during lockdowns, global container throughput regained its pre-pandemic level of activity relatively quickly. However, shortages across numerous dimensions—namely in labour, warehouse space, and truck trailers—have meant supply has struggled to keep pace with firm consumer demand.

Find Out More

Post

Is the ocean cruise sector poised for a recovery like the one post Great Recession?

Starting in 2025, the cruise industry could enter a similar cycle for rebuilding the orderbook as the number of cruise ships due to launch will decrease drastically.

Find Out More