Quick Take – US correction to continue

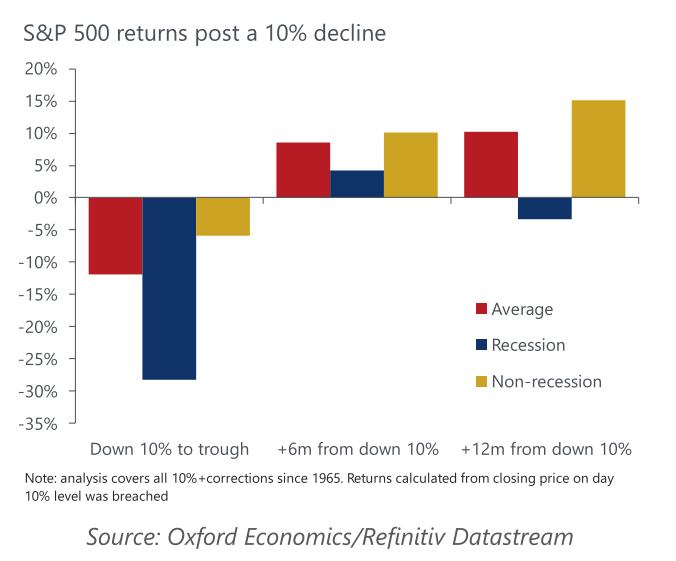

US equities dipped into correction territory last week and we see the risk of more downside in the near term, as valuations remain expensive relative to safe assets, investors have yet to capitulate, and earnings momentum is stalling.

Tags:

Related Posts

Post

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Find Out More

Post

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

Find Out More

Post

How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

The supply-shocks era (2020-23) represented the first time in a generation where inflation significantly eroded the real value of global public debt. In this week’s video, Gabriel Sterne, Head of Global Emerging Markets, focuses on the extent to which governments seized that opportunity.

Find Out More