Quick Take – Turning constructive on US high-yield credit

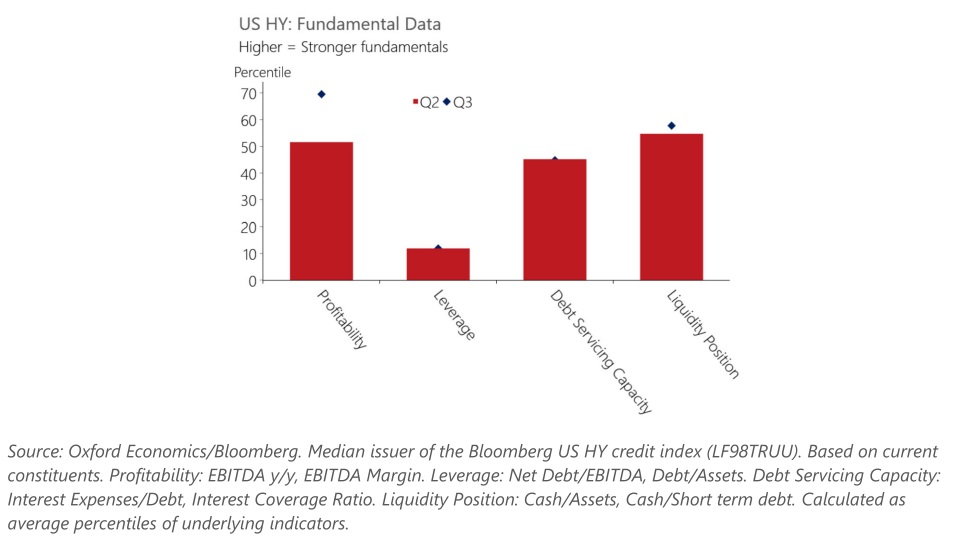

We think US high-yield spreads will trade at or below 400 bps throughout this year. Upward revisions to our US 2024 US GDP growth forecast and improving corporate fundamentals mean that a sub-2% default rate for US HY credit by 2024 year end can be achieved.

What you will learn:

- This suggests high-yield credit is likely to outperform both DM bonds and equities over our tactical horizon, and we will promote the asset class to overweight (from underweight) within our Global Asset Allocation, released next week.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More