Property sector risks haven’t gone away

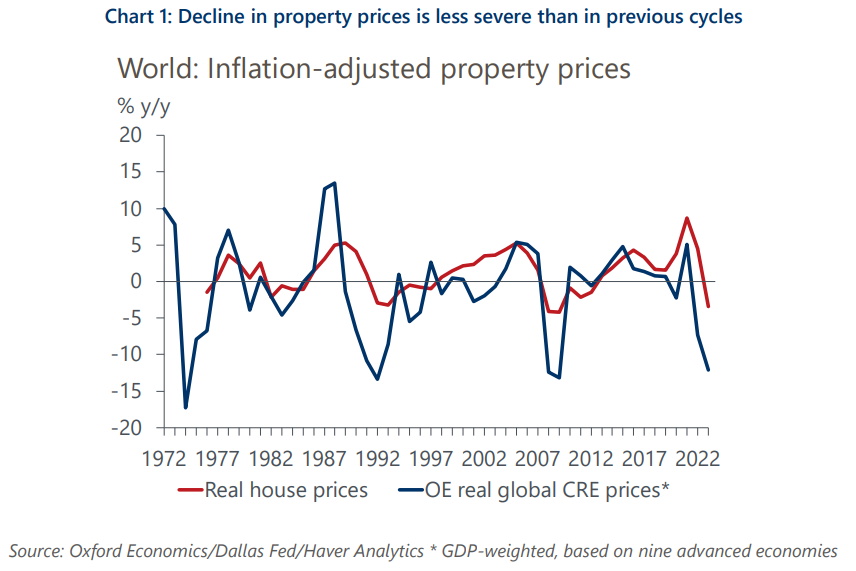

Overall, the downturn in the property sector is much less severe than in some previous cycles, especially for residential property. This is good news for growth. Still, property sector risks haven’t gone away yet, especially in the troubled commercial real estate (CRE) area.

What you will learn:

- Global real house prices fell 3.4% last year, which compares to double-digit falls in the previous two downturns. CRE prices, however, fell 19% in real terms from 2022-2023 which is starting to look comparable to the 25% falls in the early 70s, early 90s, and the global financial crisis.

- The decline in residential construction so far in advanced economies also compares favourably to previous cycles and overall construction has been boosted by unusual strength in non-residential structures. Meanwhile, CRE investment has slumped badly.

- Leading indicators like mortgage approvals and construction orders are still weak, especially in Germany. Distress indicators like mortgage arrears are also low, but it looks likely that in the near term, real house prices will flatline or decline slowly and housing construction stay subdued.

- The biggest risks are concentrated in the CRE sector. The decline in prices looks quite rapid historically and recent news has featured stories of large CRE sector write downs in the office sector.

Tags:

Related Posts

Post

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Find Out More

Post

Four themes are shaping US real estate markets

This year is set to be a turning point for commercial property markets in the US. A gradual easing of inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-Covid adjustment. But there are four important themes market participants will need to understand to navigate the short and medium term successfully.

Find Out More

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More