Property risk premiums rising but will remain below average in Australia

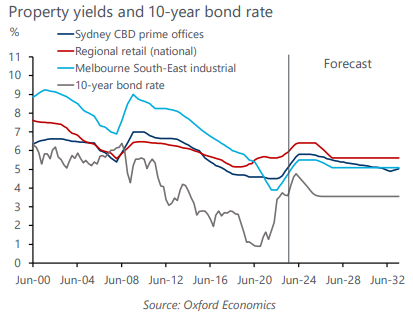

Australian bond yields have risen over the past 18 months, highly influenced by movements in the US, reflecting more hawkish expectations for policy rates and a higher term premium. As is the case overseas, we think that markets are currently overstating where policy rates will ultimately settle and expect bond rates will come back from their current level in time. That said, we have recently revised our forecast for Australian 10-year government bond yields higher, stemming from an upgrade to our estimate of the neutral rate of interest in the US. We now expect the Australian 10-year bond yield will settle around 3.5% from mid-2026, down from 4.3% at the time of writing.

What you will learn:

- The Australian commercial real estate market is currently in the process of adjusting to a period of higher bond yields, which have pushed up investors’ cost of capital and in turn their required rates of return. Property yields commenced softening in H2 2022 and the process of capital values adjusting to higher interest rates has further to play out, likely over the course of 2024.

- The yield spread to bonds averaged 265bps for prime Sydney CBD office; 310bps for regional retail shopping centres; and 345bps for Melbourne South-East industrial over the last 10 years.

- Property risk premiums are expected to rise near term. However, we think they will remain below historic average levels during the forecast period, influenced by our market rental growth forecasts as the 10-year government bond yield settles around 3.5%, down from 4.3% now.

Tags:

Related Research

Post

The socio-economic impact of TikTok in Australia

This report provides the results of our economic modelling of TikTok’s economic contribution to the Australian economy, as well as the findings of survey research into TikTok’s users and Australian businesses. It looks at the real world impacts users report as well as the diversity of TikTok’s online communities.

Find Out More

Post

Australian office sustainability outcomes underpin asset performance

The focus on green office buildings and sustainability is being driven by both government targets to achieve net zero and increasing corporate and investor focus on environmental, social, and corporate governance (ESG) considerations and compliance.

Find Out More

Post

Indian and Australian cities to outpace rivals over 2024-28

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

Find Out More