Policymakers singular focus adds to rate cut uncertainty

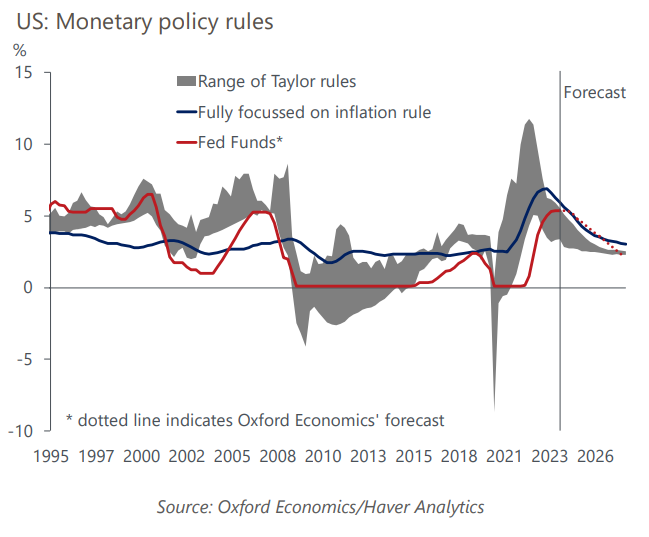

Our baseline forecast for policy rates is consistent with central bankers continuing to focus almost exclusively on inflation. Their laser-like inflation focus and higher-for-longer bias are understandable after such a large and sustained inflation overshoot. But once inflation is firmly back at target and this bias reverses, it will eventually be a key source of downside risk to our policy rate forecasts.

What you will learn:

- If central bankers were to adopt a more balanced consideration of growth and inflation dynamics, then – based on our forecasts and a range of monetary policy rules – rates would fall more quickly than we and the markets currently anticipate.

- Inevitably, central banks will eventually swing to putting more emphasis on growth prospects in their decision making – probably once the inflation battle has been decisively won and questions over credibility have been silenced. But the timing will be subjective and so this, in addition to the uncertainty around our forecasts for inflation, is a key risk to our forecasts in the years ahead.

- The longer that central banks remain at the hawkish end of the spectrum, as implied by simple policy rules, the greater the chance that inflation may undershoot in the medium term.

Tags:

Related Posts

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

United States: Student loan payments are less concerning going forward

Despite last summer's US Supreme Court decision, the Biden administration has forgiven $153bn in student loan debt through piecemeal actions. This, combined with a new, more generous income-driven repayment plan and a yearlong grace period following the end of the pandemic-era pause on student loan payments, has reduced the amounts borrowers in the aggregate are paying back to the Department of Education.

Find Out More

Post

UK : The everyday economy matters to local economic performance

The everyday economy generates half of all UK employment and 33% of GVA but is often dismissed because it generates less growth than high value services and has low productivity. But indirectly it has the capacity to improve the competitiveness and performance of local economies and has been identified by Labour Party leaders as a sector to focus on, if they win the election.

Find Out More