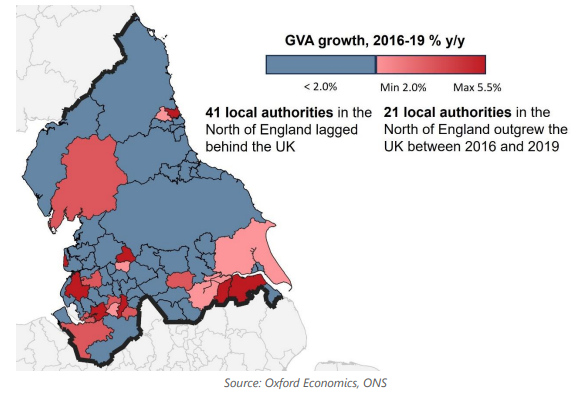

Only a few northern economies will outperform the UK

While economic growth in the north of England is generally below the UK average, that is not always the case. In 2016-19, 21 northern local authority districts, or a third of the total, outpaced the UK for GVA growth, some of them substantially, and with the City of Manchester leading. Unfortunately, we forecast that the number will fall to just seven in the 2024-28 period.

What you will learn:

- The City of Manchester led the northern GVA growth league in 2016-19, while its Greater Manchester neighbours, Stockport and Salford, were both in the top ten. Salford managed that despite a decline in productivity, whereas the City of Manchester saw balanced growth, reflecting increasing numbers of high-value, knowledge economy workers. That is a trick that few northern cities are really pulling off.

- Indeed, it is apparent that the better performing parts of the north pre-pandemic had very different drivers, with no over-arching pattern of success.

- To address poor economic performance, Combined Authorities spanning local areas are intended to take advantage of local linkages, so that by pooling powers, success in one place can produce success in neighbouring local economies. Greater Manchester provides an example of that working, but not perhaps for the combined authority area as a whole, or at least not yet.

- Indeed, our own forecasts do not assume that combined authority status will have a material impact on local area economic performance.

Tags:

Related Posts

Post

Three reasons why UK inflation will swiftly return to target

The UK inflation outlook has been transformed by steep falls in oil and gas prices and the recent softening in core price pressures. We now expect CPI inflation to average 2.1% in 2024, down from our November forecast of 3.1%. Inflation is on track to return to the 2% target in April.

Find Out More

Post

Eurozone: Nowcasts show a cold start to 2024, but warming later

Our suite of nowcasting models corroborates our tepid near-term expectations for the hibernating eurozone economy, indicating Q1 growth will come in at 0.1% q/q. This is a touch below our 0.2% q/q baseline forecast, though the spread of results across our models plus mixed signals from latest data highlight the uncertainty around the immediate growth outlook.

Find Out More

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More