No change in policy as BoJ waits for wage data

The Bank of Japan left both short-term and long-term policy rates unchanged at Tuesday’s meeting. Amid a decline in global yields, pressures on the Yield Curve Control (YCC) policy framework from bond and foreign exchange rate markets have eased.

What you will learn:

- Recent data confirm our view that inflation will continue to decline for several quarters pressures from past import inflation abate. More data on the 2024 spring wage settlement is needed to assess the prospect of achieving the 2% inflation target in the coming years.

- Meanwhile, the BoJ’s review of monetary policy is progressing. At a recent workshop, the bank’s staff papers argued that past easing has “contributed to creating a non-deflationary environment,” but it estimated this added only about 1ppts to the inflation rate.

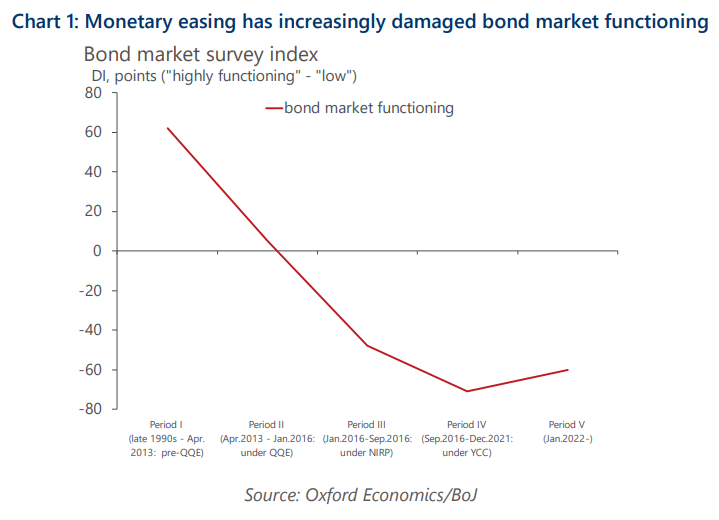

- The staff papers highlighted the negative side-effects on bond markets from aggressive quantitative easing and the introduction of unlimited fixed-rate purchase operations to defend the YCC ceiling. The papers also showed the side-effects of the negative interest rate policy.

- We maintain our call that the BoJ will abolish the NIRP at the April meeting next year after confirming a robust spring wage settlement.

- The ‘review’ is expected to be concluded in mid-2024 but the BoJ will not rush to exit QE in our view. The exit will be delicate, requiring many years and comprehensive policy measures in conjunction with the government to ensure a smooth and stable process.

Tags:

Related Posts

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More

Post

Japan inflation to rise to 1.8%, but downside risks are high

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

Find Out More

Post

Surprisingly strong wage data ends NIRP and YCC in Japan

The Bank of Japan (BoJ) decided to end its negative interest rates policy and set the target band for the overnight market rate at 0%-0.1% at Tuesday's meeting, earlier than our call for April.

Find Out More