Next BoJ governor hints at a return to policy orthodoxy

We think the BoJ’s next governor, expected to be respected scholar Kazuo Ueda, will shift cautiously to a more orthodox policy framework centred on the control of the short-term policy rate. Although Ueda will likely maintain the zero-interest rate policy, we think he will also look to reduce the side-effects of some measures including the Yield Curve Control (YCC) policy.

What you will learn:

- To buy time for the review amid persistent market pressures, the BoJ will likely widen the tolerance band for the 10-year JGB yield from 50 bps to 75bps or 100 bps in Q2. Though an outside chance, we don’t exclude a decision as early as the March meeting to ensure a smooth transition period. But even after widening the band, we believe that it will remain as a safeguard against yields potentially overshooting during the process exiting QE.

- We think the review is likely to conclude that progress towards achieving the 2% inflation target has been made and that the current accommodative monetary policy stance should be continued with some adjustments to reduce side-effects. This will give the BoJ flexibility to adjust the policy framework by reversing some easing measures before achieving the 2% target in a stable manner.

- Possible adjustments the BoJ could consider include ending the negative short-term policy rate that has hampered financial intermediation in money market. The BoJ will likely maintain the short-term policy rate at 0% to support the economy and to keep long-term yields low.

- We project very cautious steps to exit from aggressive QE policy. Although Ueda would like to see more market-led formation of long-term yields, the reduction in the pace of JGB purchases will be gradual.

- Our revised BoJ policy outlook will have a relatively limited impact on growth and inflation with little change in short-term rates and bank lending rates.

Tags:

Related Resouces

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

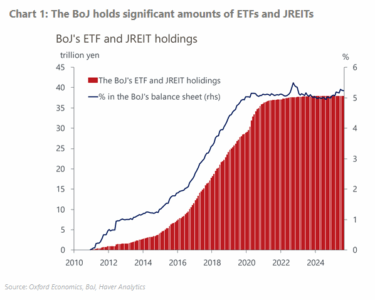

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More