Research Briefing

| Feb 23, 2024

Names will never hurt me –EM monetary credibility remains intact

Emerging market (EM) central banks’ credibility to restrain inflation over the medium-term horizon remains intact despite the tests it’s been subjected to in an age of supply shocks and massive income disappointments – and despite name-calling by some banks’ political masters.

What you will learn:

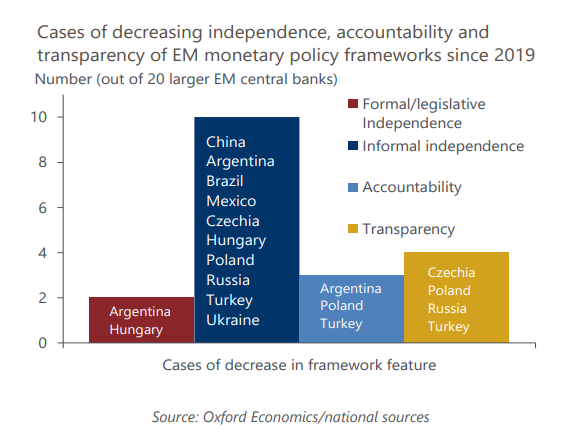

- We surveyed our economists’ views on 20 EM central banks; these reveal some examples of erosion in independence, accountability and transparency since the era of supply shocks began in 2019. But only in Argentina and Turkey do we see these as attacks of the metaphorical “sticks and stones” variety, which would represent a threat to the bones of price stability.

- Numerous instances of erosion of informal independence justify concern. These include frequent criticism by politicians of central banks (Brazil, Colombia, Hungary, South Africa) and politicised appointments to policymaking roles (Brazil, Mexico, Czechia, Poland).

- But actions speak louder than words or rules. Monetary policies since 2019 have kept ahead of the curve in the very same countries where informal independence appears to have been eroded, including Brazil, Colombia, Czechia, Hungary, and Poland.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Macro Strategy Service

Global insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More