More pain still to come for Canada from the mortgage payment shock

Mortgage payments have soared since the Bank of Canada began aggressively hiking interest rates in early 2022, and there is more pain to come as borrowers continue to renew their mortgages this year. This will particularly squeeze low-to medium-income indebted households, likely requiring most of them to cut discretionary spending and forcing those in more dire cases to sell their homes.

What you will learn:

- Low-to medium-income indebted households will bear the brunt of the mortgage payment shock. With little spare income, excess pandemic savings, or the ability to take on more debt, their total mortgage payments could rise by as much as C$4bn this year, or about 0.5% of their current total nominal consumption.

- The spending pullback by low to medium earners will be partly offset by higher-income households, who are better positioned to cope with higher mortgage payments and still maintain their current levels of consumption and continued strong population growth.

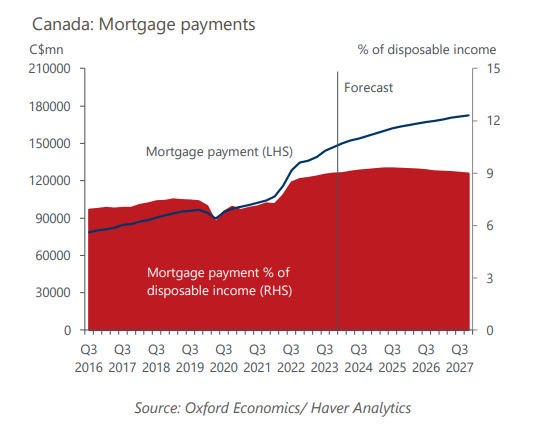

- Even with interest rates expected to begin easing in H2 2024, we forecast total mortgage payments will increase by another 6%, or C$9bn to C$156bn by the end of 2024 and by 18%, or C$26bn to C$173bn by the end of 2027. This will take mortgage payments’ share of disposable incomes to a peak of 9.3% by mid-2025, up sharply from 7.2% in Q1 2022 and the highest on record dating back to 1990.

Tags:

Related Services

Service

Canada Macro Service

Comprehensive coverage of the Canadian economy, providing clients with all of the information they need to assess the impact of developments in the economy on their business.

Find Out More

Service

Canadian Province and Metro Service

Data and forecasts for Canadian provinces and metropolitan areas.

Find Out More

Service

Canada Provincial Territorial Model

A rigorous and comprehensive framework to develop forecasts, scenarios and impact analysis at the national, provincial and territorial levels.

Find Out More