Monetary policy in ASEAN shifts focus

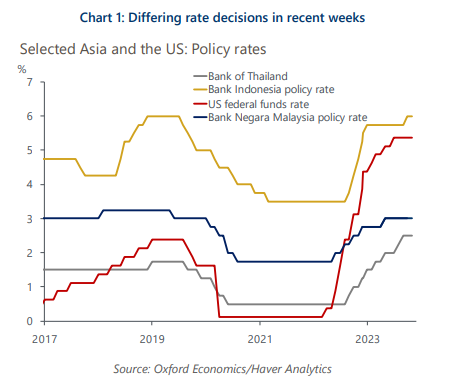

Over the past few weeks, the outlook on policy rates has come under even more scrutiny than usual. It appears, at least for now, that the US Federal Reserve is done with rate increases even though the jury is out on when they will cut rates or how fast the pace of rate reductions will be. Our view is that the first cut is not likely until the second quarter of next year and, even then, the pace at which rates are reduced will be slower than current market expectations.

What you will learn:

- With the US Fed expected to remain on hold for a prolonged period, rate decisions in Asia are likely to become more idiosyncratic. We discuss the actions of three central banks, namely Bank Indonesia (BI), Bank Negara Malaysia (BNM), and the Bank of Thailand (BoT).

- BNM left the policy rate unchanged at 3% despite the currency at its weakest versus the USD in decades. Its balance of risks shows a greater emphasis on internal dynamics where inflation is below 2% and, despite a rising growth rate, there is persistent slack in the economy.

- The BoT has taken the policy rate to its highest level in more than a decade. This is despite inflation being below its target range of 1%-3% for months. The most recent print was -0.3% for October. We think they are building policy space to tackle a possible growth slowdown.

- While country-specific factors are affecting the current policy stance, we think it is a matter of time before the systemic effect of a global growth slowdown becomes dominant. Market volatility is likely to restrain monetary easing in the near term, but rates are still likely to come down across Asia in 2024.

Tags:

Related Posts

Post

The costs and eventual benefits of smooth decarbonisation in ASEAN

Reaching net zero carbon emissions by 2050 would likely have a larger impact on economic activity initially in ASEAN5 countries than more gradual decarbonisation. But our modelling suggests the gap would narrow in later years and turn positive in most places approaching 2050.

Find Out More

Post

The miracle growth story of Vietnam has further to unfold

Vietnam's GDP grew by an average rate of 7% annually in the past three decades, surpassing all its ASEAN regional peers. Although 2023 and 2024 are set to see Vietnam's weakest growth outside of Covid years, we think the pain is short-term.

Find Out More

Post

Three key idiosyncrasies in Asian trade and why they matter

Idiosyncrasies in recent Asian trade data suggest that country-specific factors are becoming more influential and causing some countries' exports to buck cyclical trends. If that continues, the fortunes of regional exporters will diverge further in 2024, though we still think the overall export trend will be subdued.

Find Out More