MENA: Key themes 2024 – The GCC will defy the global slowdown

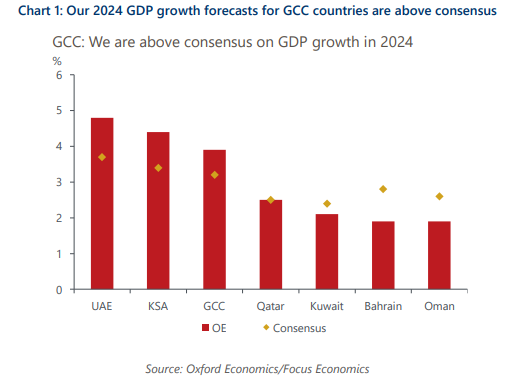

The Gulf Cooperation Council (GCC) region will expand less than we initially thought this year, but growth will improve in 2024 and outpace most advanced and emerging economies. There are four themes that shape our above-consensus 2024 GDP growth forecast for the GCC of 3.9%.

This research report expands on these key themes:

- Energy sector will see a slow turnaround. We expect regional producers to stick to oil supply curbs in the near-term, before unwinding them later in 2024. This will translate into a positive contribution to overall growth from the energy sector after a retreat this year.

- The non-energy economy will remain decoupled from global trends. Our key call for 2024 is that non-energy sectors drive overall growth with expansion of 4%. Government policies will underpin this resilience; we see a broadly stable fiscal outlook, and growth in off-budget spending in Saudi Arabia and the UAE. Meanwhile, GCC inflation will hover at a comparatively low level in a global context.

- Tourism and renewables will remain key diversification engines. We see steadfast investment in non-energy sectors, including tourism and renewables, as it is the essence of regional development visions.

- A widening of the Israel-Hamas war would upend 2024 outlook. Our optimistic view is vulnerable to a regional war escalation scenario through the prospect of disrupted oil supply, negative impact on investment and travel demand, and a deterioration in the global macro backdrop.

Tags:

Related Posts

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More

Post

Arabian Gulf Business Insight: Middle East escalation would have severe market implications

Scott Livermore, Chief Middle East Economist at Oxford Economics discusses how energy market disruption would be substantial and global oil supply would contract by around 6%.

Find Out More

Post

Global Economy: Scott Livermore on oil output strategy, economic diversification importance for GCC growth plans

Scott Livermore, Chief Economist and Managing Director at Oxford Economics, examines the intricate dynamics of the GCC economies.

Find Out More

Post

GCC: Key themes shaping city economies in the near term

For Gulf cities, the near-term outlook will be tied not only to the global macroeconomic backdrop, but also the progress of the diverse visions and strategies in the region. With the aim to diversify their economies and reduce the dependence on oil, Gulf states continue to invest in the non-oil economy and implement various reforms. That said, oil revenues remain key to funding diversification efforts.

Find Out More