MENA: Key themes 2024 – The GCC will defy the global slowdown

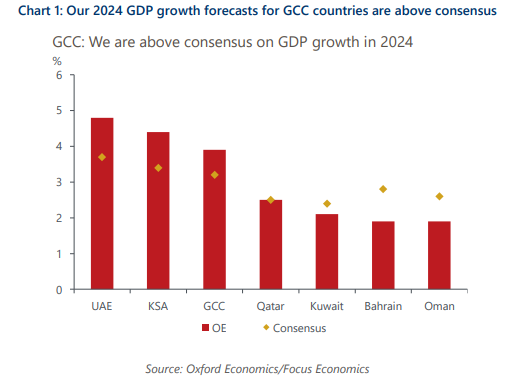

The Gulf Cooperation Council (GCC) region will expand less than we initially thought this year, but growth will improve in 2024 and outpace most advanced and emerging economies. There are four themes that shape our above-consensus 2024 GDP growth forecast for the GCC of 3.9%.

This research report expands on these key themes:

- Energy sector will see a slow turnaround. We expect regional producers to stick to oil supply curbs in the near-term, before unwinding them later in 2024. This will translate into a positive contribution to overall growth from the energy sector after a retreat this year.

- The non-energy economy will remain decoupled from global trends. Our key call for 2024 is that non-energy sectors drive overall growth with expansion of 4%. Government policies will underpin this resilience; we see a broadly stable fiscal outlook, and growth in off-budget spending in Saudi Arabia and the UAE. Meanwhile, GCC inflation will hover at a comparatively low level in a global context.

- Tourism and renewables will remain key diversification engines. We see steadfast investment in non-energy sectors, including tourism and renewables, as it is the essence of regional development visions.

- A widening of the Israel-Hamas war would upend 2024 outlook. Our optimistic view is vulnerable to a regional war escalation scenario through the prospect of disrupted oil supply, negative impact on investment and travel demand, and a deterioration in the global macro backdrop.

Tags:

Related Posts

Post

UAE’s 2026 federal budget signals stronger growth and investment

The UAE has set a balanced federal budget of AED92.4bn for 2026, a 29% jump in both revenue and spending, underpinned by new tax measures and an expected uplift from hydrocarbons. The plan channels funds towards social services and strategic investments aligned with the ‘We the UAE 2031’ vision.

Find Out More

Post

GCC: Fed rate cut unlocks further boost for domestic demand

Blog MENA: Key themes 2024 – The GCC will defy the global slowdown The resumption of the US Fed’s rate cutting cycle in September 2025 is set to create a more favourable credit environment across the economies of the Gulf Cooperation Council (GCC). With regional currencies closely pegged to the US dollar, moves by the...

Find Out More

Post

Why GCC consumers are set to continue to outperform

As GCC governments focus on diversifying economic activity and revenue sources away from oil and gas, our analysis suggests that household spending in the region will outperform that of international peers.

Find Out More

Post

Saudi Arabia’s PIF: Driving diversification through strategic investments

Saudi Aramco’s 20-year, $11bn lease deal with Global Infrastructure Partner (GIP), a firm under BlackRock’s umbrella, for Jafurah Field Gas Plant underscores the growing international confidence in Saudi Arabia’s ongoing economic transformation.

Find Out More