UK Key themes 2024 – Tight policy settings weigh on growth

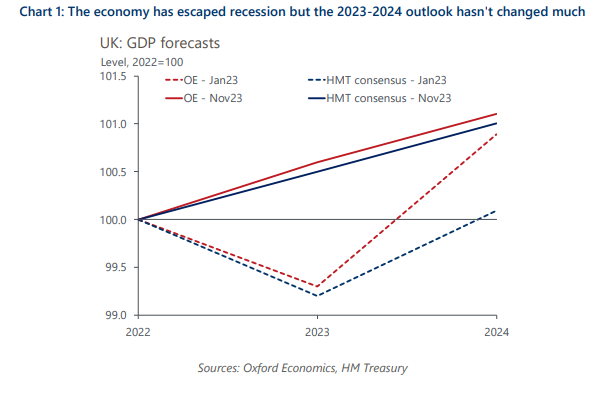

We expect the UK economy will struggle to gain momentum in 2024. Pressures on consumers and firms from high inflation are now easing, but the economy faces major headwinds from the lagged impact of monetary policy tightening and tight fiscal policy settings. We think three key themes will shape the outlook next year.

What you will learn:

- The economy will tread water as it moves from dealing with one shock to another. The inflation shock is receding and real wages should continue to recover in 2024. But with more borrowers being forced to refinance their mortgages at much higher rates, the impact of past monetary tightening will continue to build. The support from universal energy subsidies has been withdrawn, so real income growth will be subdued next year.

- The broader impact of tighter monetary policy will spread. Poor mortgage affordability will keep housing transactions very low and the affordability correction in house prices will continue. The impact of higher mortgage costs will be seen in rising arrears and repossessions and is likely to spill over into unsecured credit. The company sector will also be affected by rising insolvencies, with higher interest rates just the latest in a string of cost shocks that firms have had to deal with.

- There is light at the end of the tunnel. The labour market remains on course for a soft landing and growth prospects should improve from H2 2024 as inflation drops back to target. We could also get further temporary fiscal loosening in the run-up to the general election. A Labour win – likely according to polls – might yield a more stable political environment, but we expect the next government will find itself boxed-in by the poor fiscal inheritance left by the current one.

Tags:

Related Posts

Post

UK Key themes 2024 – Tight policy settings weigh on growth

The UK's house price correction has been mild so far and recent data has indicated the market may be more resilient than we had thought. But we still think the downturn has some way to run.

Find Out More

Post

Global Key Themes 2024 – Few opportunities in a gloomy landscape

Global GDP growth and inflation will slow in 2024 and central banks will begin to pivot in H2 – at least that seems to be the broad agreement among markets, policymakers, and forecasters. For the most part, we concur and have identified three key themes that will be key to the precise path that economies and financial markets take next year.

Find Out More

Post

UK: Labour’s plans brush up against fiscal realities

Should Labour win the UK election next year, we doubt it would be able to generate a marked improvement in UK GDP growth in its first term. Inheriting a poor fiscal position from the current government, high debt servicing costs, and restrictive fiscal rules will limit its room for manoeuvre.

Find Out More