Global Key Themes 2024 – Few opportunities in a gloomy landscape

Global GDP growth and inflation will slow in 2024 and central banks will begin to pivot in H2 – at least that seems to be the broad agreement among markets, policymakers, and forecasters. For the most part, we concur and have identified three key themes that will be key to the precise path that economies and financial markets take next year.

This 6-page research report expands on these key themes:

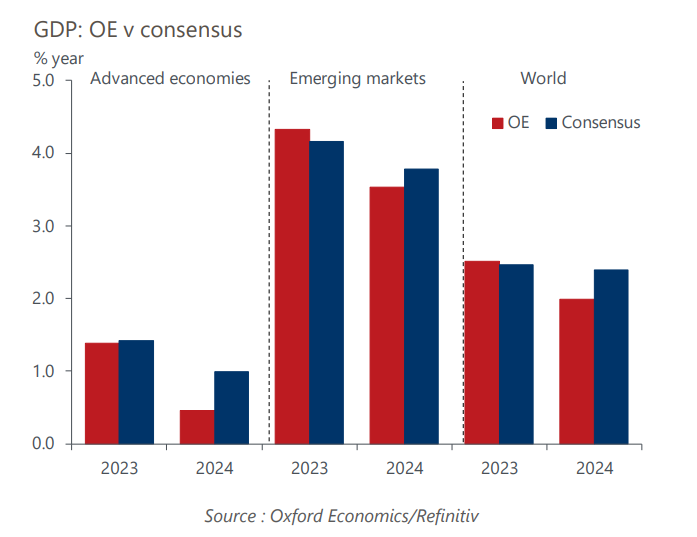

- Risks to the consensus growth view are skewed to the downside. Our baseline global GDP growth forecast for 2024 is below consensus. One key risk factor is ‘payback’ next year for US and Chinese households front-loading spending in early 2023.

- Another factor is the likely ebbing next year of the surprise strength of some interest-rate sensitive sectors, in part due to monetary policy taking longer to feed through to the real economy. Fiscal policy also is on track to tighten in 2024 and will start to push in the same direction as monetary policy.

- Inflation trends will diverge more. Despite being more pessimistic on the growth outlook, we expect inflation in most economies to remain sticky and fail to deliver any positive downward surprises. The key exception is the eurozone. There we think inflation will fall more sharply than others expect, driven mainly by weaker energy and food inflation.

Tags:

More Research

Post

Experian / Oxford Economics Main Street Report

Experian/Oxford Economics’ Main Street Report brings deep insight into the overall financial well-being of the small-business landscape, as well as provides commentary on what specific trends mean for credit grantors and the small-business community.

Find Out More

Post

Global Climate Service: Divergent policies & the cost of uncoordinated action

The Global Climate Service quantifies the macroeconomic impacts of five climate scenarios against a stated policies baseline. These scenarios help businesses understand the trade-offs and implications of climate mitigation.

Find Out More

Post

Why investors view Mexico as LatAm’s new safe haven

We forecast the Mexican peso will appreciate by 4.9% in 2023 to an average of 19.2/US$, up from 20.2/US$ last year. This will be an unprecedented three-year streak of gains and one of the largest among EMs.

Find Out More