Japan: Ueda is determined to avoid premature tightening

The Bank of Japan (BoJ) left short-term policy rates at -0.1% and long-term rates at around 0% at today’s policy meeting. With less pressure on the 10-year JGB yield and some improvement in market functioning, the BoJ saw no reason to tweak its Yield Curve Control (YCC) policy.

Despite upside surprises on the growth and inflation fronts, we believe the BoJ will maintain the status quo for another year or so to assess whether the economy is on track to achieving 2% inflation within Governor Ueda’s five-year term. In his first speech as Governor, Ueda stressed the risk management approach in policymaking and the high cost of premature tightening.

What you will learn:

- While ongoing structural changes pose high uncertainties, we project that CPI inflation will fall short of the 2% target even in 2028. Key developments to watch are 1) sustainability of a wage rise amid a secular labour shortage, especially prospects for spring wage negotiation in 2024, and 2) firms’ price-setting behaviour after the recent great price passthrough.

- If he sees little prospect of achieving 2% inflation in a stable manner by mid-2024, we believe Ueda will spend the rest of his five-year term exiting from those easing measures with significant side-effects rather than continuing the “whatever-it-takes” strategy.

- Over the next year, the BoJ will conduct “a broad-perspective review” of monetary policy. We believe that the focus will be on quantitative easing and YCC policy. Conducting the review in an open manner involving academics will help the BoJ build consensus in the society on which easing measures to end.

Tags:

Related posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

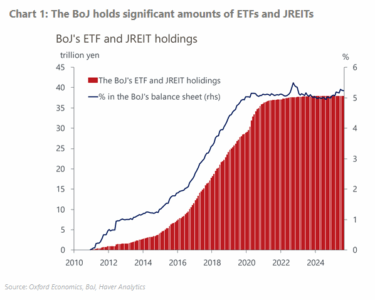

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More