Research Briefing

| Dec 6, 2023

Japan Key themes 2024 – Will wage-led inflation gain momentum?

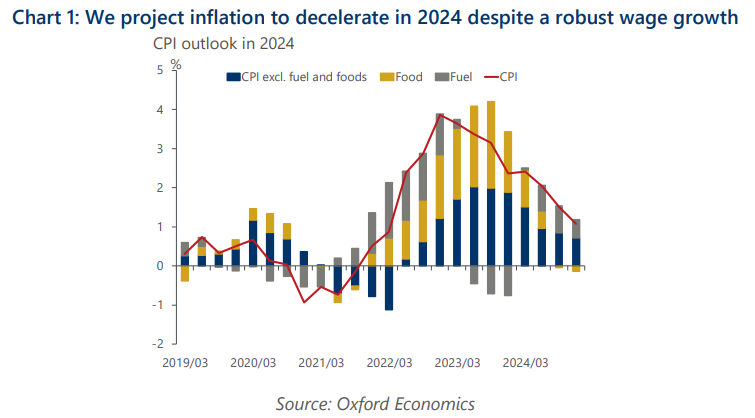

Inflation will likely decelerate in 2024 as the impact of imported inflation wanes. We expect the Bank of Japan will end its negative interest rate policy in April after confirming a high wage settlement. But our medium-term projection is that a zero-interest rate policy will take its place and last for years.

This research report expands on these four key themes:

- Risks to our inflation outlook are high and skewed to the upside. The pass-through of imported inflation could persist longer than expected. More importantly, a labour shortage could make firms’ wage and price setting behaviour more aggressive, undermining our call that wage rises will not be strong enough to achieve 2% inflation in the next five years.

- The ongoing structural transformation could boost the wage-led inflation dynamic. Higher labour turnover could raise wages and productivity. On top of Japan’s corporate governance reforms, the labour shortage promotes higher profitability through business restructuring and aggressive pricing strategies to keep wages rising. The exit of zombie firms will also lift productivity.

- Speculation over Bank of Japan policy will persist. The highly uncertain inflation outlook and the BoJ’s communications will stoke market speculation about further policy rate hikes. The yield curve control framework could also be challenged – even after the tweak in October – if the US monetary policy pivot and the projected decline in global yields is delayed.

- The yen will strengthen, but the pace will be gradual and two-way volatility will persist. Despite significant uncertainty regarding monetary policy in Japan and the US, rate differentials remain large, sustaining carry trades. On the other hand, the relative resiliency of growth and corporate earnings will be positive for the yen.

Tags:

Related Services

No Posts Added