Japan: Incoming Governor Ueda is entrusted to tweak the YCC

At Governor Kuroda’s final policy meeting, the Bank of Japan (BoJ) left short-term policy rates at -0.1% and long-term rates at around 0%. Despite mounting pressures on the 10-year JGB, the target range was kept at +/-0.50ppt.

While we did not discount the possibility of a widening of the band to secure a smooth leadership transition, Kuroda appears to have avoided a sharp rise in JGB yields before the end of the fiscal year. In particular, further losses in the domestic bond portfolio threaten the profitability of the already vulnerable regional banks.

What you will learn:

- The decision to uphold policy rates comes at a cost. The BoJ will be forced to continue its massive JGB purchases to stem speculation of additional YCC tweaks, which will worsen market liquidity.

- Higher inflation is fuelling upward pressure on yields. The mid-February Tokyo CPI offered little relief on core-goods price hikes. We expect core-goods inflation to stay elevated until Q2, before calming down as cost pressures abate.

- Under Kazuo Ueda’s leadership, we think the BoJ will tweak its current Yield Curve Control (YCC) policy in Q2 to let off market pressures and buy time for a review of the overall policy framework.

Tags:

Related Resouces

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

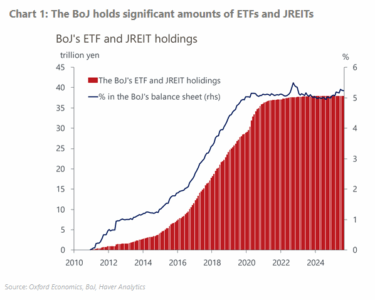

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More