Japan fiscal rigidity intensifies with fast-aging and soaring debt

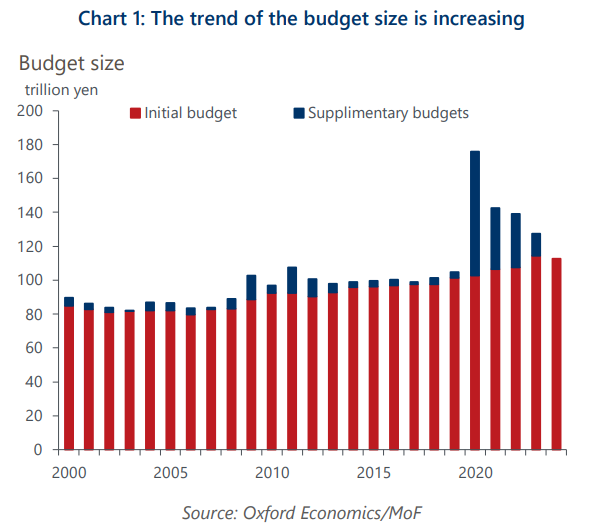

The effective size of the FY2024 initial budget continues to expand, led by structural pressures from fast-aging, rising debt servicing costs, and the increasing needs for defence spending. Fiscal rigidity has intensified as the government has no intention to hurry fiscal consolidation.

What you will learn:

- Social security expenses, which account for one-third of the budget, rose by 1 trillion yen from FY2023. Higher interest rates increased debt servicing costs by 2 trillion yen, reaching almost one-fourth of the budget. National defence spending rose by 1 trillion yen, following the government’s plan to double its size in five years to 2% of the GDP by 2027.

- Tax revenues are expected to remain the same as in FY2023, as political decision to cut income tax temporarily to support households will offset the additional revenue induced by an economic recovery.

- Although the FY2024 budget foresees a visible improvement in the primary balance, we are doubtful of its feasibility, given that it has become customary to have a sizeable supplementary budget at year-end in recent years regardless of economic conditions.

- The effective primary fiscal deficit during the pandemic was much smaller than budget figures and returned to balance in a short period because of the unspent amount and a rising share that is transferred to strategic funds which are not spent immediately

Tags:

Related Posts

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More

Post

Japan inflation to rise to 1.8%, but downside risks are high

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

Find Out More