Indonesia rate cuts will bolster credit demand, with pockets of risks

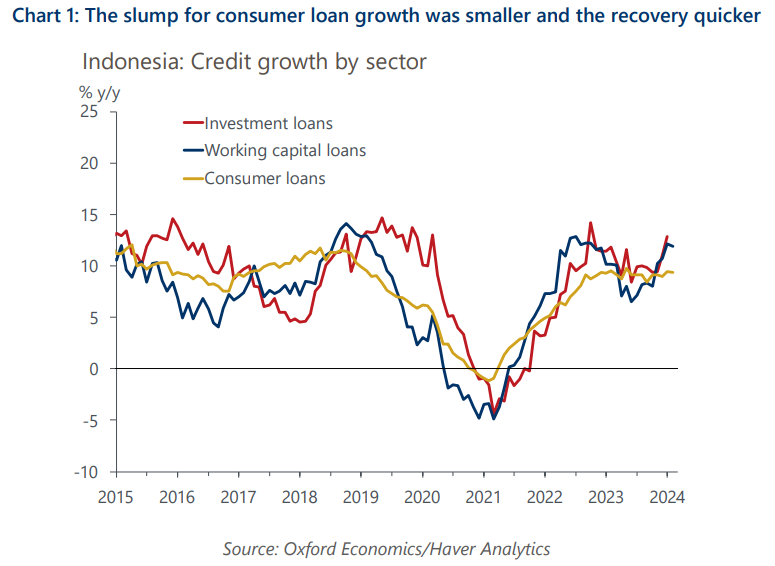

We forecast Bank Indonesia will start cutting its policy rate in Q2, which will provide a cyclical tailwind for credit growth and consequently domestic demand, as lower real lending rates will help boost loan demand.

What you will learn:

- Demand for consumer loans remains historically high as households struggle to make ends meet due to low earnings, even though they now face less pressure from high inflation. We think labour market conditions will remain poor this year, so loan demand will likely remain strong, further boosted by declining real rates.

- Business loan demand is also healthy given plateauing real lending rates, but the growth outlook depends on the usage. Improving liquidity will reduce demand for working capital loans, while the strong domestic sector will bolster investment loan demand. However, the soft external sector will likely be a drag.

- Initial signs of downside risk are emerging. The nonperforming loans (NPLs) ratio for consumers is rising, though is still at a low level. Similarly, the share of household income allocated towards debt repayment is rising from a depressed level, suggesting at least some households are starting to suffer as loans come due.

- There are also structural headwinds buffeting growth beyond the near term, such as the lack of financial deepening, which would require more fundamental solutions.

- Aside from rising NPLs for consumers, banks’ liquidity is low, which could be a barrier to extending long-term investment loans. But banks’ lending standards appear relatively loose compared to history given ample capital buffers, vast deposits, and high provision for losses.

Tags:

Related Posts

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

The costs and eventual benefits of smooth decarbonisation in ASEAN

Reaching net zero carbon emissions by 2050 would likely have a larger impact on economic activity initially in ASEAN5 countries than more gradual decarbonisation. But our modelling suggests the gap would narrow in later years and turn positive in most places approaching 2050.

Find Out More

Post

The Deglobalisation Myth: How Asia’s supply chains are changing

Despite talk of deglobalisation, a quantitative analysis of intermediate goods show global supply chains have continued to expand in the last five years. Amid a volatile world economy, swiftly evolving supply chains are minting new winners and losers in global trade.

Find Out More