Indonesia likely to miss fiscal target in 2023

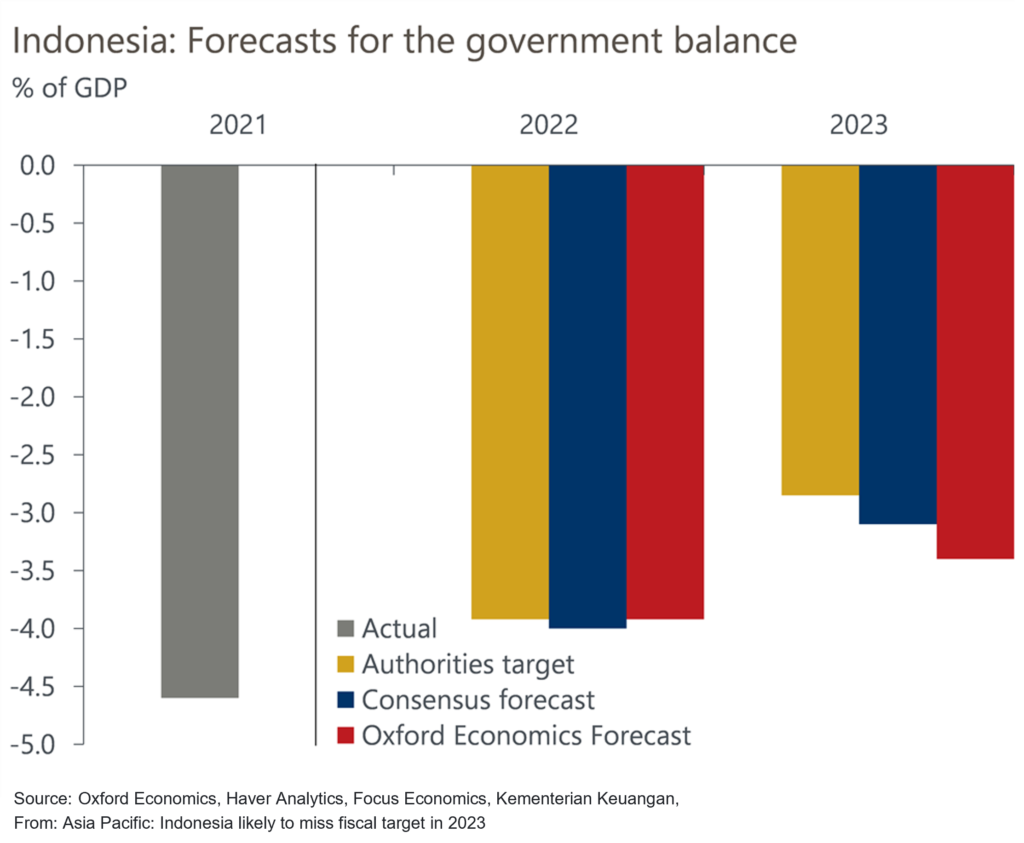

We expect Indonesia’s budget balance to show a large deficit in H2 of this year as the cost of fuel subsidies is finally reflected in the fiscal accounts. And we forecast the budget deficit to narrow to 3.4% of GDP in 2023 from 3.9% this year, versus the government target of 2.85%.

What you will learn:

- This year, Indonesia recorded its first H1 budget surplus since 2011 with recent figures showing continued surplus in July and August. The marked turnaround in the fiscal position so far this year is down to both soft expenditure and soaring revenues. But the data do not give a full picture of the underlying fiscal situation.

- The issue is that much of the cost of fuel subsidies is yet to be reflected. In Indonesia, most subsidies are delivered through administered prices. The state-owned distributors are then reimbursed by the government for their losses, usually at the end of the year or in the following year.

- We believe Indonesia’s government fiscal consolidation in 2023 likely to fall short of plans. The subsidy bill is likely to fall more slowly than the government is expecting in its 2023 budget, based on our higher assumption for global oil prices. In addition, the government’s revenue projections look too optimistic, with tax collection forecasts not fully reflecting the likely negative impact of the recent fuel price hike on GDP growth.

Tags:

Related Resouces

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Singapore Business Awards 2024

We're delighted that Oxford Economics has been announced as the Most Innovative Global Economic Forecasting Specialists 2022.

Find Out More

Post

The long-term trends shaping global city consumer markets

Our long-term income and consumer spending forecasts reveal the high-potential urban consumer markets of the future. We identify four key trends underpinning shifts across global urban consumer markets over the coming decades.

Find Out More