How US demographic shifts will drive housing starts

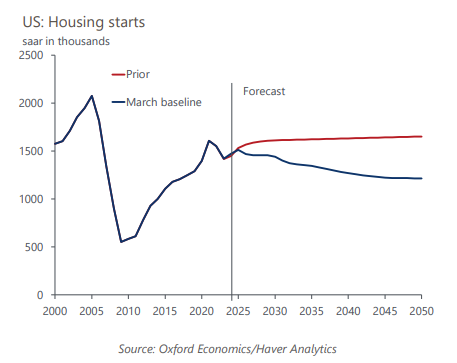

In our March baseline we revised down substantially our long-term forecast for housing starts to better align it with our updated population projections. The new forecast is for housing starts to decline gradually to a 1.2mn seasonally adjusted annual rate by 2050, compared with 1.6mn in the February baseline.

What you will learn:

- Housing starts feed into GDP via residential investment, accounting for roughly half this component. The revision to the housing starts forecast lowered the contribution from residential investment to annual, long-run GDP growth by less than 0.1ppts on average.

- Household formations are a key driver of our housing starts forecast. But our new bottom-up projections also include starts needed to replace homes lost to obsolescence, to meet demand for second homes, and to make up for the shortfall in housing units that has accumulated since the global financial crisis.

- In our March baseline, we revised existing home sales higher as a reduction in the supply gap should lead to more transactions in the existing home market – population aging will also likely contribute to an increase in sales. We revised down new home sales, which are more closely tied to housing starts.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

City Climate Analysis

In-depth insights into the economic impacts of climate change and mitigation policies on cities and local economies throughout Europe, the US and Canada.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More