How China is reframing its Africa strategy

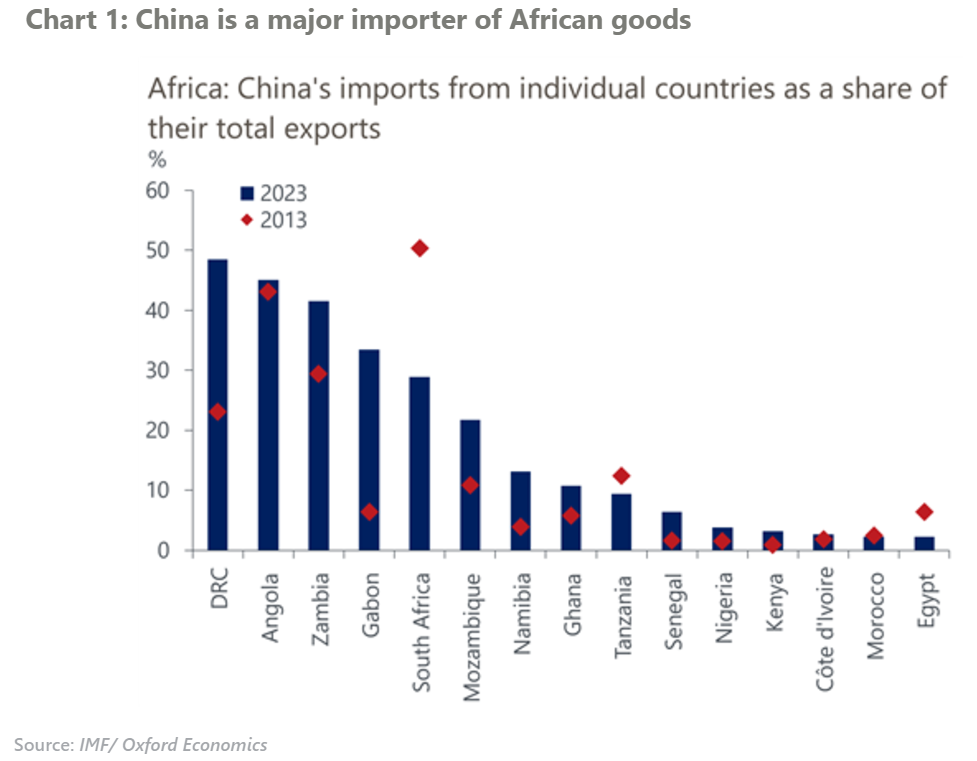

We think the impact of the stimulus announced by China on the prices of commodities exported by Africa will be limited. What matters more is China’s changing long-term strategy on the continent.

What you will learn:

- China is shifting its focus in Africa away from a mineral extraction-for-export model towards investment in industry, local value chains, and processing capacities. Coupled with a growing focus on its ‘green transition’ strategy, this presents opportunities for African economies with natural reserves of the minerals and metals these industries need.

- Still bearing the scars of recent debt restructurings in Africa, China is looking to limit its direct exposure to African government balance sheets while still expanding its influence on the continent. Instead, it increasingly favours private investment by Chinese companies in Africa and panda bond issuances by African sovereigns and financial institutions.

- China’s shifting financing strategy may change the nature of balance sheet risks affecting Africa, transferring risks away from the public sector to private sector balance sheets.

- We don’t think bilateral funding taps are completely shut for Africa, amid increasing geopolitical competition on the continent between the US and China, plus the entrance of new potential partners such as the Gulf States, India, and Turkey.

Tags:

Related Posts

Post

Commodity Key Themes 2026: Softer oil prices and firmer metals

In this report, we outline five key themes that will shape the global commodity landscape in 2026.

Find Out More

Post

Commodities outlook 2026: Another challenging year ahead

Looking ahead, we anticipate a modest contraction in 2026 for aggregate commodity prices, with US natural gas and precious metals likely to remain relative outperformers.

Find Out More

Post

Policy-driven volatility ahead for critical metals

Industrial strategy, not scarcity, has become the new source of commodity price turbulence.

Find Out More