Growth outlook determines the fate of fiscal consolidation in APAC

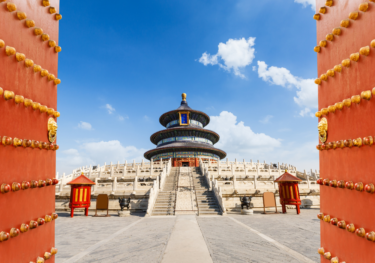

As we highlighted in May, public debt accumulated during the pandemic leaves Asian economies with limited fiscal space, which makes fiscal expansion unlikely for most in the years ahead. We expect fiscal consolidation to generally continue in Asia, except in mainland China and Taiwan. In those economies, we anticipate looser fiscal policy this year and very slow normalisation next year.

What you will learn:

- In China, we expect more policy support as weak activity data show momentum is fading fast. The growth pickup from here will remain largely reliant on policy easing. But large fiscal stimulus is still unlikely as the central government is focusing more on the quality of growth, while recognising its limited fiscal space.

- China’s experience offers valuable lessons to other Asian economies as most are likely to slow towards the end of the year and into 2024. We do expect fiscal consolidation will generally continue, but the pace will be very gradual amid growth headwinds.

- Another burden for Asian economies is the debt accumulated during the pandemic. Interest servicing costs remain high in most economies, which will make fiscal consolidation an even trickier task.

Tags:

Related Posts

Post

Rapid ageing a tailwind for the aged care sector in Asia Pacific

We believe aged care is emerging as a prominent sector in Asia with a robust growth outlook.

Find Out More

Post

The Deglobalisation Myth: How Asia’s supply chains are changing

Despite talk of deglobalisation, a quantitative analysis of intermediate goods show global supply chains have continued to expand in the last five years. Amid a volatile world economy, swiftly evolving supply chains are minting new winners and losers in global trade.

Find Out More

Post

The big questions for China macro policy this year

Ahead of this spring's Two Sessions, we expect officials to realistically stake their growth target at around 4.5% in 2024 – a more sustainable, though likely still above-potential, pace than in 2023.

Find Out More