Global Industry: Red sea attacks are a shot across the bow of global logistics

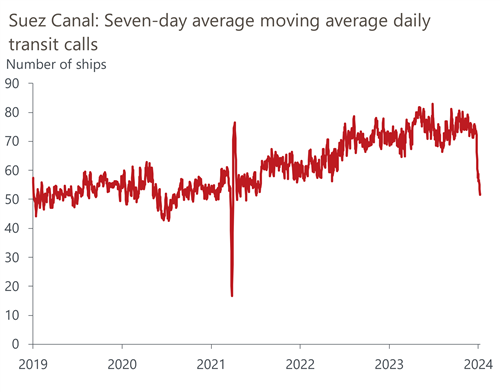

The attacks on container ships by Houthi militants have, once again, revealed the underlying fragility of the international supply chains upon which the global economy relies. The longer the attacks go on and the more ocean freight carriers decide to avoid transit through the Suez Canal, the greater the disruptive effects will end up being.

What you will learn:

- We have already seen spot rates for ocean freight shoot up in recent days and, given the increasing number of carriers and ships avoiding the Suez Canal, it seems inevitable that, at least for a time, there will be increases and delays in the time it takes to ship products by ocean. This will initially largely affect goods traversing routes between Asia and Europe, which has the potential to disrupt supply chains of industries like construction, automotive, chemicals, and machinery that rely on intermediate imports from the Asia-Pacific region.

- On the positive side, any reduction of ocean freight supply would coincide with subdued global trade and industrial demand, which will likely prevent problems from spiralling as they did in 2021/2022.

- The direct effect on the global water transport industry is likely to be relatively muted: equity prices of major ocean freight companies have increased in anticipation of higher freight prices, but there is still likely to be a degree of oversupply given a number of container ships being added to the global fleet. Water transport output is a small fraction of most countries’ transportation & logistics sectors and proved resilient to increased prices during the pandemic.

- The most direct negative impacts in the short run are likely to be felt in Egypt, where the transport & logistics sector relies heavily on activity related to the Suez Canal. A longer drought of container ships using the canal would be negative for the economy and government finances.

Tags:

Related Posts

Post

Red Sea shipping attacks add to inflation risks

We assume the disruption to shipping caused by maritime attacks on commercial vessels in the Red Sea will be relatively short-lived and the recent spike in sea freight prices will reverse. While there will be near-term impacts for some firms and sectors, these won’t be enough to shift our baseline economic or inflation forecasts to any meaningful extent.

Find Out More

Post

Global logistics challenges more than just port bottlenecks

The pandemic has tested the adaptability and resilience of transport and logistics companies. With consumers focusing their spending on goods rather than on services during lockdowns, global container throughput regained its pre-pandemic level of activity relatively quickly. However, shortages across numerous dimensions—namely in labour, warehouse space, and truck trailers—have meant supply has struggled to keep pace with firm consumer demand.

Find Out More

Post

US supply chain stress fell at the start of peak shipping season

Supply chain strains eased in September after increasing slightly in August. Transportation pressures subsided the most of all our tracker's components, price pressures recorded a third straight monthly decline, and inventories improved.

Find Out More